Investor relations (IR) are crucial to a hedge fund’s growth and reputation, and with rising competition, hedge funds are increasingly adopting hedge fund CRM software to automate workflows and strengthen relationships with investors. The best CRM for investor relations helps manage investor data, personalized interactions, reduces repetitive tasks through automation, and confirms compliance with regulatory requirements. It enables hedge funds to organize, track, and manage both current and prospective investors efficiently, centralizing data, streamlining operations, and improving communication. This customization fosters trust, enhances investor relationships, and supports investor onboarding, subscription management, and compliance with regulations like KYC and AML. Ultimately, hedge fund CRM software improves data-driven decisions, boosts investor confidence, and optimizes operational efficiency.

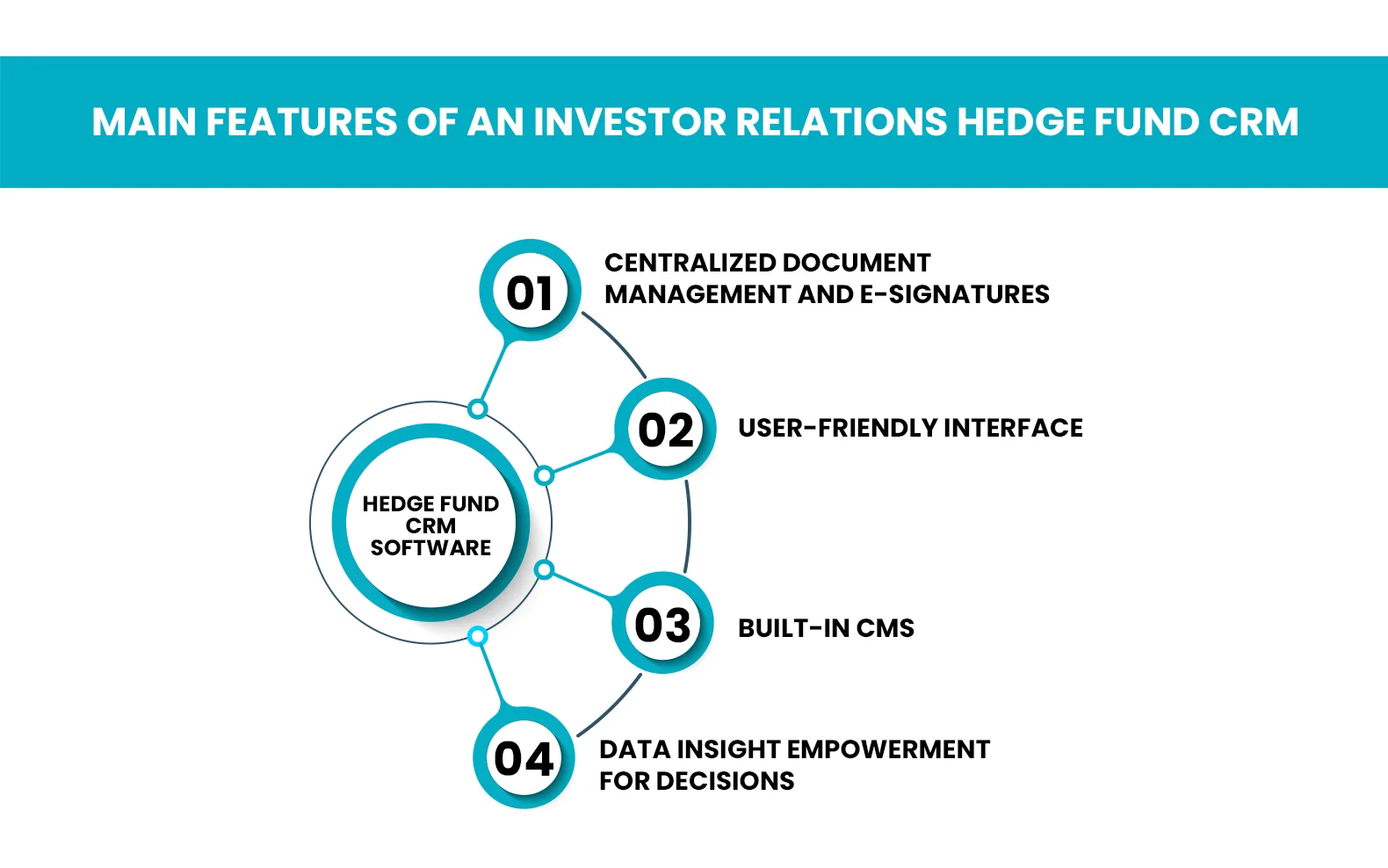

Main Features of Best CRM for investor relations Hedge Fund CRM software

Centralized Document Management and E-Signatures

An investor-centric CRM should facilitate a safe, paperless document management system where investors can access these documents digitally and provide electronic signatures, regardless of location. It ensures that signed contracts and agreements are kept centrally in one area for easy access later, allowing quick searches for documents without breaking compliance. This system provides smooth transactions while assuring investors of record-keeping.

The CRM incorporates investor communications that go beyond standard processes, entailing aspects of sales and marketing. An all-rounded CRM also offers integration into inbound support, allowing the IR team to effectively handle outreach targeted towards particular investors while being able to monitor their involvement and subsequently answer queries, providing a consistent experience. Such coordination helps hedge funds deliver communications responsive to their investors’ requirements and maximize investor satisfaction.

The best CRM for investor relations offers these comprehensive capabilities to ensure hedge funds maintain and grow their competitive edge in a demanding investment landscape.

User-friendly interface:

An easy-to-use interface is the foundation for effective navigation in productivity maximization and learning curve minimization. An intuitive, user-friendly interface in a hedge fund CRM would enable teams to navigate and utilize critical functions effectively; teams can spend more time building relationships than working through complex systems. Clean design and accessibility allow the most nontechnical people to handle investor interaction easily.

Integration with Financial, Documentation, and Signature Platforms The hedge fund CRM should seamlessly integrate into essential tools such as accounting platforms, document storage, and e-signature software. All these would allow IR teams to tap into the information across a variety of systems in a single, unified CRM so that data silos could be minimized and more administrative work could be minimized. Consolidating information within one platform helps maintain the consistency of the data so that IR teams have a complete view of each investor’s engagement history.

Built-in CMS:

A native CMS enables investor relations teams to publish content and updates, providing value to investors. The feature is essential for funds that require updates on the performance of the fund and market information from the investors. Articles, reports, and related content from the hedge fund’s brand can be shared with the investors through the CMS built into the software, promoting transparency and improving the investor experience.

Practical Applications of Hedge Fund Best CRM for investor relations.

1. Lead Management and Relationship Building

Establishing relationships with potential investors is based on identifying and developing leads. The CRMs of hedge fund management will enable the IR team to rank leads, track engagement, and follow up on leads frequently via email, live chat, or phone. By following up on leads promptly with a high conversion rate, hedge funds will likely convert better and develop trusting relationships with new investors.

2. Investor Sessions Coordination and Management

Investor relations teams regularly meet with the investors to give them fund performances and discuss new investment opportunities. An automated hedge fund CRM has streamlined appointment management with the ability to have reminders of appointments to the investor and the IR team so they never miss a time. They are always set to go for the session. That minimizes scheduling conflicts and further enhances the organization’s communication with investors.

3. Deal Pipeline and Investment Pipeline Management

Investor relations also involve negotiating share prices, fund entry points, and other investment terms and conditions. Hedge fund CRM has a structured deal pipeline that tracks all the details in each negotiation so everything runs smoothly. This systematic approach keeps the IR team organized, provides the capability to prioritize, and efficiently manages deals.

4. Monitoring Fundraising and Investment Performance

A hedge fund’s growth is primarily through fundraising and tracking financial contributions. A hedge fund CRM tracks fundraising activities and reports any changes in investor participation and campaign effectiveness. Such tracking further supports streamlining fundraising processes and quickly calculates the level of investor engagement over time.

5. Guaranteed Information Sharing and Knowledge Base

The heart of investor relations is the component of transparency; hedge fund CRMs make it easy to share such critical information with knowledge bases and portals of investors in a very secure manner. IR teams can share data on the funds with real-time access to details of funds, updations, and material financial documentation with investors through these portals. That enhances investor confidence and brings them up-to-date information about the performance and strategy of the fund.

Operational Efficiency

Hedge fund CRM software enhances operational efficiency by consolidating investor data in one centralized location. Investor data management is often labor-intensive, with many manual processes and data entry tasks. CRM software streamlines and automates such tasks, reducing the chances of errors and ensuring data availability. Workflows within the CRM can handle regular procedures such as document handling, investor onboarding, and even compliance checks. It saves time while helping ensure that certain processes always execute correctly to make overall operations more reliable.

It eliminates duplication and keeps all investor data categorized and logged so that investor interactions, emails, and other documents can be easily tracked. Miscommunication will be minimal while fund managers are provided to deliver service quality; consequently, it helps the firm maintain a professional and organized image.

Creation of the Personalized Investor Experience

Personalization has become an important factor in improving investor relations in the cutthroat world of hedge funds. Investors prefer to be regarded as important, valued individuals rather than as a component of a broad portfolio. The CRM tool helps hedge funds personalize communications concerning unique preferences and history and each investor’s communication patterns. Fund managers could use this data to build messages and provide updates for different investors. That creates feelings of being valued and being trusted.

Another key feature CRM offers is the ability to monitor the feedback received and investors’ engagement in fund management so that their strategy can be adjusted appropriately to investor sentiments. Predictive investor needs, answering questions before a problem surfaces, and developing greater relationships with the possibilities provided by hedge funds using analytical capabilities through CRM. To such an extent of personalization, it induces loyalty, increasing possibilities for longer partnership terms.

Data Safety and Compliance

Hedge funds are highly regulated companies that strictly adhere to data protection and compliance rules. CRM software for hedge funds typically helps observe these regulatory requirements through built-in compliance management tools that facilitate funds’ adherence to European guidelines such as GDPR and SEC regulations in the United States. The compliance modules in CRM software are there to monitor the regulatory requirements, document the changes, and send automated alerts if something is not compliant. Therefore, an organization is saved from court battles and penalties.

Another important area is data security. Investor information, especially for high-net-worth investors, is sensitive and must be safeguarded against breaches. Most hedge fund CRM software incorporates higher-level security features such as encrypted communication, role-based access, and audit trails. These features assure the fund manager and investor that their data is secure, which may play a significant role in retaining and trusting investors.

Data Insight Empowerment for Decisions

CRM software gives Hedge funds advanced data analytics and reporting facilities, which is indispensable in making informed decisions. It analyzes and understands interaction history, investor preferences, and feedback related to data from investors, providing insightful knowledge regarding investor behavior. This will offer information through which patterns and trends arise, helping fund managers develop data-driven decisions related to investor expectations and prevailing market conditions.

AI-powered CRM systems can take these insights further by using predictive analytics to identify trends before they fully emerge. For example, AI can predict potential shifts in investor preferences or which investors might be interested in new fund opportunities. Using such insights, hedge funds can proactively engage investors with timely information and opportunities, thus improving satisfaction and potentially driving new investments.

CRM is a strategic decision in investor relations and fund operations. A hedge fund software should seek features that best cater to its needs, such as compliance tracking tools that help manage the convoluted regulatory demands of the industry. The investor portal with the self-service option allows clients to log into their information, view the performance of the funds, and download the reports themselves. This, too, is a facility that adds to the convenience of the investor who wishes to be more transparent in the deal.

Report customization and analytics capabilities are important so hedge funds can prepare reports according to investor requirements and preferences. The integration aspect is also of the essence since hedge funds usually run different systems in trading and risk management. At the same time, CRM software, which integrates harmoniously with such tools, enhances the workflow efficiency and accuracy of the data. Another important aspect of AI-based insights is accurately predicting and analyzing investor behavior.

Right Selection of Hedge Fund CRM Software Provider

Hedge funds should look at factors other than features when evaluating a CRM provider. Cost and scalability are significant factors in selecting a suitable CRM software. Smaller hedge funds require an affordable solution that is scalable for growth. Another critical factor is ease of use because a complex system can make operations slow down and cause users to be frustrated. Further customizability becomes necessary; special funds have specific needs, which the CRM can perhaps fulfill better for themselves.

Vendor reputation is equally important because a supplier specializing in hedge funds ensures that highly specialized help and industry knowledge are also available. An excellent track record of success by a financial services provider with this type of business can ensure that the supplier recognizes the unique set of challenges that hedge funds present and, therefore, can offer relevant insight and additional support not only to the successful implementation but to subsequent uses of the tool as well.

Actual Applications of Hedge Funds Using CRM Software

Most hedge funds have already seen the revolutionary changes introduced by CRM software in their practices and investor relations. For instance, efficiency is significantly improved through the adoption of hedge fund CRM software; some firms reported that automation has reduced time spent on routine work, and resources can be utilized for top-strategic work. Case studies have also shown several investors’ successful retention and growth by applying CRM software with the help of personalized communication and building transparency and responsiveness.

These real-world examples emerge clearly from the direct material advantages of CRM software on hedge funds, including timesaving and cost-saving, increasing investor satisfaction and loyalty. Hedge funds that use CRM instruments successfully will achieve an even more structured, precise, and secure environment, meaning the overall investor experience will be excellent.

Challenges and considerations for implementing CRM software.

Despite the many advantages of CRM software, its implementation is not without problems. Data privacy is a serious issue, especially because investors’ information is highly personal; therefore, hedge funds must first choose robustly secure data CRM software compliant with regulations and ensure investor data protection.

The third challenge is new technology. CRM software will imply an organizational cultural change for employees accustomed to traditional work.

Proper training and support during the transition are essential in persuading people to use the new system.

The Future of Hedge Fund CRM Software

The future of CRM technology in hedge funds will be increasingly more sophisticated. More prevalent applications of AI, the adoption of blockchain for data safety, and cloud-based CRM solutions with scalability and access are emerging trends. CRM technology will evolve further as a more powerful tool to attract investors, increase transparency, and streamline the operations of hedge funds.

CRM software will play a much greater role in investor relations. It will integrate all such innovations as real-time data analytics, mobile CRM access, and advanced AI-driven insights, enabling hedge funds to offer investors a service much more aligned with growing investor expectations. Anticipating such trends and investing in cutting-edge CRM solutions, hedge funds will gain an edge in building strong, lasting relationships with their investors.

Top 10 CRM Solutions for Investment Firms to Consider in 2024

Alternative investment software solutions are key to the investment landscape, improving client relationships, streamlining operations, and allowing for data-driven decision-making. A good CRM can be transformative for investment firms, centralizing data, improving client service, and enhancing productivity. Here’s a look at ten top CRMs for 2024, each tailored to help firms leverage data more effectively and elevate their workflows.

1. Salesforce

It has become one of the most flexible CRM systems widely adopted across all industries. Developed first for investment management, it is now a force behind teams in various departments that use tools such as Customer360 to help them develop more intelligent workflows with connected data and AI-driven insights. It’s an excellent alternative for investment firms looking for a scalable and customizable platform to help them handle their clients and run the business more efficiently.

2. Microsoft Dynamics 365

This system, Microsoft Dynamics 365, is a set of powerful CRM solutions that developers created with intelligent business applications in mind. It provides businesses’ sales, marketing, financials, and other strategic departments with operational efficiency – that’s why it became very popular in financial services. Since the system reduces complications and costs, firms also become more agile, ensuring they can please the client while increasing productivity and collaboration.

3. Opscheck

Designed specifically for workflow management in financial firms, Opscheck offers a highly customizable CRM solution that integrates seamlessly with your existing systems. It provides essential tools for managing client interactions, tracking compliance, and streamlining operations, making it a valuable resource for businesses focused on risk management and regulatory adherence.

Opscheck integrates smoothly with other software platforms, ensuring efficient application coordination and an enhanced user experience.

4. Backstop Solutions

Backstop Solutions is one of the first CRMs specifically designed for investment firms, and it continues to be a leader in this niche. It helps institutional investors, private fund managers, and advisors centralize and manage critical data, streamlining effective communication and decision-making. Backstop’s CRM helps companies maximize client relationships by empowering users to access relevant information quickly and securely.

5. DealCloud

DealCloud helps investment firms aggregate relationships and deal management within one interface. It allows the reduction of internal data silos alongside third-party silos so that all are aggregated in a single place and is more helpful for the optimization of deals as well as client relations for those firms. Its CRM tools have improved coordination between various sections of the firm while helping an investment firm make appropriate data-driven decisions.

6. SatuitCRM

SatuitCRM is a strong alternative investment software solution for purchase management, hedge funds, and private equity CRM. Whether cloud or on-premises, SatuitCRM will provide clients with rich tools for client interaction and compliance data. This allows firms to track their data and ensures compliance, giving them an excellent client relationship management tool that can be interfaced with third-party services.

7. Dynamo Software

has been well-experienced for two decades in developing fundraising tools and CRM of an alternative investment ecosystem. The organization provides personalized communication tools and third-party data integration into a cloud-based system. So, it provides solutions to both GPs and LPs or service providers. This flexible solution of Dynamo Software encourages high-performance efficiency while efficiently maintaining sound relationships with firm clients.

8. Affinity

Affinity is a firm that makes deals in private capital with a relationship intelligence specialist, which allows customers’ relationships to feed automated CRM tracking and analysis while the flow of billions of points of data. Thanks to that process, valuable, helpful, fruitful connections could appear easily. For such an issue – focus on good quality and the approach toward problems as well as the sources for updating activity minimizing when managing deals flow together-corresponding offers of the affinity seem more than nice.

9. Juniper Square

is a private investment partnership system and a universal system for real estate, venture capital, and private equity firms. Its solutions in managing investor relationships and automated capital support result in secure data handling, making it a comprehensive alternative investment software solution. Juniper Square connects GPs and LPs at every stage of the investment lifecycle, supporting collaboration and efficient investor relations.

10. HubSpot

Although HubSpot is not solely for investment companies, its CRM is powerful and applicable to any industry. Marketing, sales, and customer service capabilities help companies handle client relationships, track sales, and improve lead visibility. Its user-friendly platform and extensive customer base make HubSpot a practical choice for firms seeking a multi-functional CRM.

Each CRM has different features for improving investor relations, data management, and operational efficiency. Investment firms can use alternative investment software to keep pace with their competitors and enhance client interaction in pursuit of growth in today’s fast-paced market.

Conclusion

A good CRM software for hedge fund organizations is a potent investment relations tool that makes communication smooth, personalized one-on-one investor interactions, and drives compliance. With the best hedge fund crm software solution, hedge funds can enjoy better transparency, a stronger connection with investors, and operating efficiencies. Adopting the right CRM software is indispensable for hedge funds aspiring to be at the pinnacle of an ultra-competitive industry where every hedge fund hopes for high performance. It would thus create a base for trust and efficiency in running hedge funds, driving the achievement of success in the long term.

FAQS:

Hedge fund CRM software is a niche tool designed to streamline client relationship management for hedge funds, making communication and operations more efficient.

Hedge fund CRM software improves investor relations by centralizing communication, tracking engagement, and providing personalized insights for better client interactions.

Hedge fund CRM software typically includes key features: investor profiling, reporting tools, compliance tracking, and real-time data management capabilities.

Hedge fund CRM software can integrate with accounting, portfolio management, and communication platforms to create a unified operational ecosystem.

Hedge fund CRM software ensures data security through encryption, access controls, and compliance with industry standards to safeguard sensitive investor information.