Introduction:

Hedge funds represent one of the most effective avenues for investors to engage globally. They function as a consolidated pool of capital sourced from various individuals, which fund managers expertly allocate for investments across diverse currencies, assets, and trading markets. This substantial pool empowers managers to build trust with significant investors and clients, ultimately guiding them toward profit and financial success. Additionally, effective Hedge Fund Billing Software is essential for managing these transactions seamlessly.

Managing hedge funds has always been risky and difficult, and that’s when hedge fund management software emerged. These software have the best tools for managing funds and reporting data promptly to help make vital decisions and avoid mishaps.

Today, in digital trading markets, hedge funds, private equities, and different investment capital have undergone drastic changes over time. From fund operations to fund accountancy, audit oversight, and investor reporting, tax requirements, compliance, and regulations have all changed significantly. As important as hedge fund management, hedge fund billing is essential to simplify all fund operations. This hedge fund billing software streamlines and automates operations and workflow and analyzes performance and accounting.

Hedge Fund Billing Software:

Hedge fund billing software is advanced financial technology equipped with essential tools for workflow automation, streamlining processes, and managing billing operations for hedge funds and other investment managers.

When selecting such software, there are many important features to consider, as the best option simplifies operations and maintains workflow efficiency.

Features of Hedge Fund Billing Software:

Engines for Fee Calculations:

As the software manages billing operations, it must have an updated fee calculation engine. It should be capable of calculating various types of fees, including management, performance, administrative, custodial, compliance, and regulatory fees. Additionally, tasks such as designing billing structures, providing discounts, and creating customized fee schedules are also integral to its functionality.

Invoice generation and delivery:

Hedge fund billing software forms invoices with components like the correct and clear calculation of several fees, the name of which type of fees, the accurate billing structure used, and the update of net asset value (NAV). These invoices shall be mailed or delivered to the investment managers automatically to avoid any inconvenience or confusion.

Statements and reporting for investors:

Investor reporting and statements are another core feature of Hedge funds billing software, where investor reporting concerns provide investors with detailed information regarding their investments, performance, and related financial activities. This feature must contain customized reporting templates, and the software should specifically support multiple report formats, whether PDF or Excel. Secondly, the report should be generated automatically and delivered to the investors without mishaps. Hedge fund billing software should provide all investors access to an online portal to regularly check their financial activities and related performances. The investment reports can be quarterly or annual performance reports, tax filings, or audit financial statements.

Investing reports should include net asset value (NAV) reports and account statements with customized reporting options.

Hedge fund billing software shall be capable of adding these crucial components of investing reports: tax implications and fees and expenses, total transaction history, investment summaries, and performance metrics like returns, financial milestones, market insights, and comparisons.

billing software compliance and regulations:

What is becoming increasingly critical now about hedge funds is their growing compliance with stipulated laws. In this regard, examples include the Dodd-Frank Act in the United States, MiFID II for Europe, and the Alternative Investment Fund Managers Directive in Europe. Notably, such regulations raise the standards for compliance by hedge fund managers. Additionally, compliance software for hedge fund billing plays a crucial role by confirming effective investment results. Specifically, it creates an opportunity to automatically track and report regulatory provisions. This key aspect, therefore, not only reduces hedge fund risks but also allows all billing processes to run efficiently.

Hedge fund billing software that accurately complies with the regulations of bodies like the SEC or Finra makes it more compatible, allowing it to automate and minimize the human effort required in regulatory filings, record keeping, and reporting. These features in software help track regulation changes, ensuring that the hedge fund’s actions comply with the new ordinances and standards.

Compliance software for hedge funds and different financial services ensures compliance with changing regulatory standards. The financial reporting and compliance tools of hedge fund billing software upgrade the data management capabilities, making hedge fund billing go smoothly and safely without any errors in audit reports.

Compatibility and integration:

The software should be very compatible and must be able to integrate with other systems and software. Different accounting systems, such as QuickBooks integration, make hedge funds billing software run more efficiently.

Hedge fund software also integrates with other portfolio management systems or accounting software. It must also be compatible with operating systems like Windows or MacOS and perform API-based integrations with, for example, OMS systems for hedge funds.

Order Management OMS Systems for hedge funds:

One of the most important API-based integrations is Order management OMS systems for hedge funds.

OMS is another software platform that allows hedge funds to manage and perform trades across several asset classes, markets, and trading areas. Integrating OMS with hedge fund billing software is very beneficial. OMS systems for hedge funds provide:

- Automated data transfer and accurate fee calculations.

- Streamlined billing and invoice generation.

- Enhanced transparency.

- Improved operational efficiency.

There are several options for OMS systems for hedge funds to integrate with billing software, like real-time integration and file-based integration, that reduce manual errors and increase efficiency and accuracy.

Scalability and High Performance:

Hedge fund billing software must include several essential features. First and foremost, it should demonstrate good performance under a high volume of transactions and data. Additionally, the software must have a scalable architecture, allowing it to effectively support the growth of expanding hedge funds. Furthermore, it is crucial for the software to streamline and smooth the billing process and reporting. At the same time, it should automate workflows and tasks, ensuring that it can adapt to business complexities even with increased data volume.

High scalability and better performance reduce costs, better decision-making skills, and enhance user experience.

User interface and experience of using hedge fund billing software:

The hedge fund billing software interface must be user-friendly, with an intuitive design and features allowing users a better experience. The user interface must be advanced and upgraded, with customizable dashboards and workflows so that a user can communicate and interact with the software efficiently with no navigation troubles. To avoid mishaps, real-time data updates and alerts benefit users in a hedge fund billing software for billing software. Mobile access with this software and multi-language support is another important feature to look for before finalizing your hedge fund billing software.

Security and safety protocols:

Hedge fund billing software must protect all investment information and performances to safeguard the client’s trust. Encryption of all the investment data and kept in secure storage to prevent any breach from a trojan or any malicious virus. This software shall contain access controls and perform accurate user authentication before allowing access to avoid data theft. As mentioned, compliance with regulatory bodies and protection regulations like GDPR makes the software quite unbreachable and more secure. Besides that, regular updates and security patches to this software make these safety protocols authentic and useful.

Customer training and support team:

The software must be dedicated to its customers, with a solid customer support team, best client communication practices, helplines, online training sessions, webinars, and tutorials. Regular updates, software maintenance, and other such events keep the customers and clients attached to the software.

Besides these features, some hedge fund billing software also works with fund administration software to manage hedge funds and maintain workflow.

Hedge fund billing software is also involved in data-driven research processes, providing authentic research, optimizing operation management, and simplifying operations like portfolio management by aggregating all assets in one place. Comprehensively track the performance of investments and funds across different asset types, assessing and mitigating risks and potential threats.

Benefits of Hedge Fund billing software:

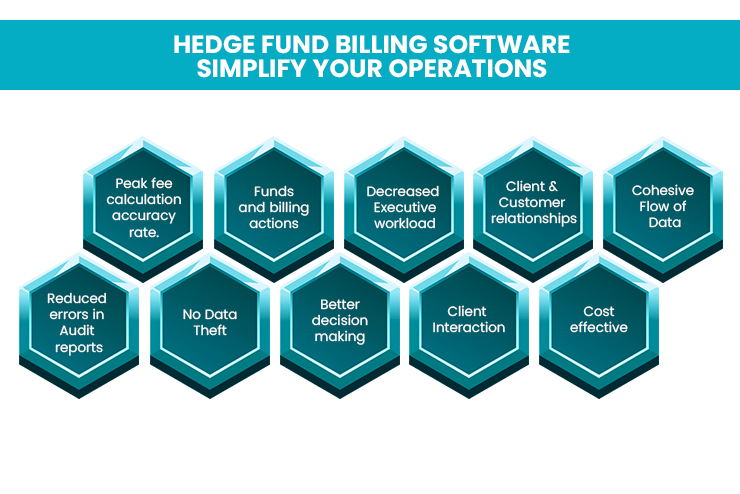

Given all the features required in hedge fund software, the benefits are self-explanatory; however, some are mentioned below.

Peak fee calculation accuracy rate: This software performs billings and automates the calculations of different fees efficiently, eventually increasing the fee calculation accuracy rate and reducing the probability of errors, decreasing manual workload, and saving cost and time.

Funds and billing actions: The software provides multiple billing structures, including performance fee, hybrid fee, flat fee, and tiered fee, which allows the funds to tailor their billing actions to specific investor agreements and contracts.

Decreased Administrative workload: Billing and invoicing are performed automatically, regular billing cycles occur, and the administrative workload on the staff is reduced.

Client and Customer relationships: Transparency with the investor and clients makes the relationship with parties more trusted and strong, leading to more investment and references from other investors.

Cohesive Flow of Data: Smooth integration with accounting software, OMS, portfolio management, and CRM systems causes a running flow of information and prevents data entry duplication.

Reduced errors in Audit reports: Maintaining detailed log and billing activities and communications and compliance with regulatory bodies provides an audit trail that can be crucial during regulatory inspections or internal reviews.

No Data Theft: The software is safe with sensitive financial and investment information and uses robust security measures and protocols to prevent data theft.

Better decision-making: By providing real-time market insights into billing metrics and revenue projections, the users can make better decisions and develop a proper strategic plan.

Client engagement: Software providing access to client online portals enhances the client’s engagement, who gets updates about his investment and improves his self-service capabilities.

Cost-effective: Helping track all the expenses associated with fund operations and management confirms that the billing accurately reflects costs and helps in profit analysis, too.

Top Hedge Fund billing Software:

Now let’s enlist top of the hedge fund billing software and their key features:

- FundCount provides comprehensive billing and accounting solutions for hedge funds and private equity firms and companies.

- Investran provides integrated billing and accounting with investment reports for different investment managers.

- Dynamo: Maintains good relations with clients and investors, provides advanced billing and invoicing, and delivers automated delivery.

- eFront: This software offers end-to-end billing, accounting, and portfolio management for hedge funds and private equity firms.

- Advent Geneva and Oracle Financial Services: These software programs offer features like integrated billing, accounting, and portfolio management for hedge funds.

FAQs

Depending on their needs, hedge funds use software programs such as reporting, billing, accounting, hedge fund management, and risk management software.

Hedge fund billing software is designed to perform tasks such as workflow automation, streamlining processes, and managing billing operations for hedge funds and other investment managers. This software enhances efficiency by automating repetitive tasks and simplifying complex workflows, ensuring that operations are both more efficient and accurate.

Yes, it is scalable. It streamlines billing processes, enhances reporting, and automates workflows and tasks, enabling it to accommodate increased data volumes and the growth of hedge funds effectively.

It reduces the chance of manual errors, increases the accuracy rate of fee calculations, reduces the administrative team’s workload, and saves time and money.

This software contains many features, such as an automated billing process, integration with different systems, and scalability, which improve overall operational efficiency.