Introduction

Compliance, accuracy, and operational efficiency are paramount in the competitive and highly regulated world of hedge fund management. Hedge funds deal with massive amounts of sensitive financial data and are under intense scrutiny from regulatory bodies. Therefore, the need for robust hedge fund audit software has never been more critical. It serves to help hedge fund managers not only with compliance and financial reporting but also increase their risk management capabilities so that they are well-equipped to navigate complex financial landscapes. This article deals with hedge fund audit software, its importance, various types, key features, and the best hedging software solutions today.

What is Hedge Fund Audit Software?

Hedge fund audit software simplifies hedge fund auditing and improves the accuracy of financial reporting. It helps hedge funds meet regulatory requirements. The software collects data, assesses risk, and generates reports. These reports allow hedge funds to review financial statements, transactions, and internal controls easily. The software reduces human error, standardizes procedures, and boosts operational efficiency. It promotes transparency, fosters investor confidence, and enables better investment decisions in a complex financial landscape.

Importance of Hedge Fund Audit Software

Hedge fund auditing software confirms that hedge funds operate with the highest possible standards and in the right legal confines. The dynamics of financial systems change constantly, hence the introduction of ever-new regulations or standards that must be attained. Therefore, hedge fund audit software allows them to automate many compliance processes, especially reporting and improving internal operations. The more sophisticated the data validation techniques, the less chance of human mistakes in hedge fund audit software; the monitoring becomes real-time, ensuring the financial reports will be correct and within the regulatory standards set.

This Software becomes significant beyond mere compliance because investor confidence is needed in the environment where hedge funds operate; thus, transparency and dependability in financial reporting need to be established. These audit software increase the integrity of data and provide the trail of audit, which might be invaluable in times of examination by a regulatory authority or internal audits. Due to the facilitation that the quick and efficient production of the required documentation gives them, audit software for hedge funds is strengthening the governance and oversight of the whole fund operations.

Advantages of Hedge Fund Audit Software

There are many advantages of hedge fund audit software. The most important advantages include automation, data accuracy, and improved compliance:

Automation and Accuracy: Hedge fund audit software automates repetitive data validation and auditing tasks, thereby decreasing the risk of human error and increasing the overall accuracy of financial data. Improved Compliance Monitoring: Updates on the changing regulations are sent to hedge funds through automated tools, thus decreasing their efforts to make manual compliances.

Better Reporting Methods: The hedge fund audit tool enables real-time accurate reports, which is one of the requirements to meet before making regulatory files and getting transparency from investors to hedge funds.

Risk Transparency and Mitigation: Many audit products have risk management capabilities whereby hedge funds can measure and understand market exposure, make judgment calls on various risks, and decide upon investments.

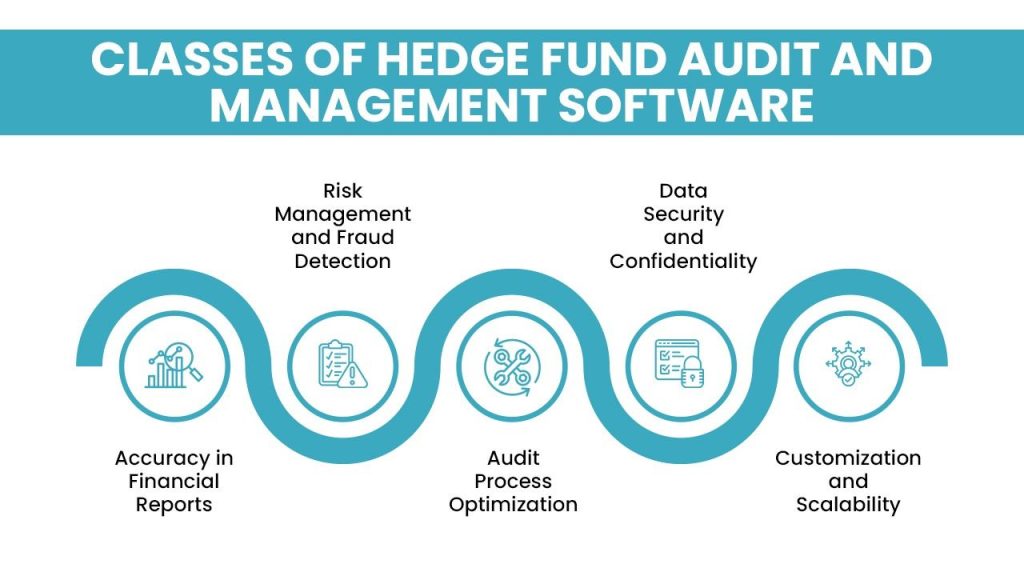

Classes of Hedge Fund Audit and Management Software

Hedge fund audit software falls into various categories based on functionality and scope. All-inclusive hedge fund platforms are built to house every aspect of fund management trading, compliance, and risk assessment in one system. Integrated systems help managers track performance, assess risks, and create reports without using multiple systems. Specialized audit management tools focus on the process of auditing alone.

Such tools provide automated data validation, compliance tracking, and audit management software for hedge funds, confirming that funds can easily navigate the complexity of regulatory requirements. Financial and regulatory reporting tools are designed to help hedge funds produce accurate reports in line with industry standards, making them essential for maintaining compliance and transparency. Another key function in the hedge fund ecosystem is risk analysis software. These applications offer advanced analytics, which allows fund managers to analyze the exposure in the market, the risks of investments, and strategies to remove potential financial threats. Risk analysis is integrated with auditing functions, giving hedge funds a more comprehensive approach to managing their operations.

Accuracy in Financial Reports

Hedge funds handle sensitive information, making data safety a top priority. Hedge fund audit software provides strong security features to protect confidential data from unauthorized access and prevent breaches. These features include encryption, user authentication, and regular security audits to comply with industry standards for data protection.

Access control features are thorough, enabling hedge fund managers to define who can access sensitive information and the actions they can take. This ensures confidentiality and prevents unauthorized individuals from accessing or modifying financial data. As a result, hedge fund audit software preserves the integrity of the audit process and protects sensitive data through effective security measures.

Risk Management and Fraud Detection

Besides improving compliance and report accuracy, hedge fund audit software plays a significant role in risk management. Most of the Software incorporates tools for risk assessment to enable managers to identify and assess risks related to investment strategies and operations. Regular audits and assessments allow hedge funds to proactively address vulnerabilities and implement strategies for risk mitigation.

Fraud detection capabilities are embedded in hedge fund audit software. Based on transaction patterns, the Software may trigger managers to identify potential fraudulent activity so that immediate and thorough investigations can be performed for resolution. This preventive measure in risk management could help safeguard the fund’s assets while protecting the potential loss of investors concerning fraudulent activities.

Audit Process Optimization

Traditional audit processes can be time-consuming and resource-heavy, requiring coordination between hedge fund managers and auditors. Hedge fund audit software automates many steps, such as data collection, document management, and report generation. This reduces the load on auditors and fund managers, freeing up time for more strategic activities and less administrative work.

It promotes collaboration between stakeholders by providing a central platform for audit-related activities. The real-time provision of necessary data and documents to auditors makes communication smoother and saves time. This would reduce the audit cycle and allow for more comprehensive audits, thus better financial oversight.

Customization and Scalability

Hedge fund audit software is generally custom-made and scalable. The needs of each hedge fund differ; based on the investment, the kind of compliance required with the regulatory obligation, and their operational structure, the needs to audit each fund may vary from others. Customization capability through the Software allows the hedge funds to change the audit according to their unique requirements.

Besides this, their audit requirements may also change as hedge funds increase and grow. Hedge fund audit software is scalable enough to accommodate growing data volumes, additional regulatory requirements, and more complex financial structures. This way, hedge funds can depend on the Software as they grow without changing their audit processes too frequently.

Data Security and Confidentiality

Hedge funds handle sensitive information, so data safety is a top priority. Hedge fund audit software provides strong security features to protect confidential information from unauthorized users and prevent data breaches. These features include encryption, user authentication, and regular security audits to ensure compliance with industry standards for data protection.

Access control features are comprehensive, allowing hedge fund managers to define who can access sensitive information and what actions they can perform. This control ensures confidentiality and prevents unauthorized individuals from accessing or altering financial data. As a result, hedge fund audit software maintains the integrity of the audit process and protects sensitive information through effective data security measures.

Which Perhaps Meant Integration with Pre-Existing Systems

Hedge fund audit software is configured to work with other financial management and accounting systems. This ensures that data flows freely between different software applications, reducing the possibility of manual data entry and errors. Such connectivity enables the software to provide an overall view of the fund’s financial health. This seamless integration streamlines the auditing process, making it easier for hedge fund managers to prepare accurate financial reports and maintain up-to-date records. The enhanced flow of data also facilitates better decision-making and reduces the risk of discrepancies or compliance issues during audits.

Real-time hedge fund performance and transaction updates are allowed with a portfolio management system and trading platform integration. Accurate reporting of financial statements will be enabled, and the hedge fund manager will be supported in his decision-making by utilizing the latest information.

Cost Considerations and ROI

Costs accompanying the implementation of hedge fund audit software include the licensing and implementation costs and the general ongoing maintenance. However, these should balance with the returns as it is likely to yield efficiency, accuracy, and risk mitigation through compliance, hence huge cost-saving in the long run.

This will ultimately help in the risk management process, thereby keeping costly penalties at bay related to compliance and damages to reputation; in addition, part of the saved time during an audit may allow the firm to execute some better strategic initiatives and enhance overall performance on average.

Top-Notch Hedge Fund Audit Software Solutions

Software providers offer robust hedging software solutions specifically for hedge funds. Among the best financial reporting and portfolio management leaders is Addepar, which allows hedge funds to track complex portfolios and develop detailed reports, which helps manage diversified investment strategies. Backstop Solutions is another leading firm that uses hedge fund tools in data management and investor relations. The firm provides hedge funds with performance tracking and compliance monitoring tools for keeping their investors informed in compliance with regulatory requirements. Allvue Systems is an alternative investment platform that provides corporate accounting, portfolio management, and compliance functionalities.

It can thus be suitable for hedge funds seeking a more integrated approach to filling multiple operational gaps. SS&C Eze is one of the oldest and most established players in the free hedge fund software space, providing a comprehensive package of trading, compliance, and portfolio management tools. It is a preferred choice for hedge funds because of its reputation for reliability and performance. Imagine Software focuses on risk analysis, and its advanced tool allows hedge funds to assess their risk exposure and run stress tests. This capability is critical for funds that must maintain complex investment strategies and be within acceptable risk parameters.

Critical Features of Hedge Fund Audit Software

One must measure several features since hedge fund audit software aims to fulfill various specific needs. Key factors in choosing hedge fund auditing software include real-time monitoring of compliance, timely awareness of regulatory changes or new requirements, minimizing manual oversight, and ensuring compliance. Hedge funds must also take security measures to protect data. Good audit software incorporates stringent security features to prevent unauthorized access and data breaches, maintaining confidentiality. Customizable dashboards and reporting tools enhance the user experience, allowing fund managers to track key metrics and generate tailored reports for stakeholders.

This flexibility helps hedge funds present data that aligns with their reporting needs and regulatory requirements. Integration capabilities are another essential feature of it. A solution that integrates with existing systems, such as portfolio management software, ensures data consistency and reduces workflow issues. This fosters collaboration and reduces the likelihood of errors from data inconsistencies. Advanced risk analysis and management tools are also crucial for hedge funds dealing with volatile markets. Software with integrated risk assessment capabilities allows fund managers to analyze risks and make data-driven decisions to protect their portfolios.

Selecting the Best Hedge Fund Audit Software

Requires careful consideration of a fund’s specific operational needs and regulatory reporting solutions. Analyze all options carefully, especially regarding scalability and user-friendliness. Look into features that support the fund’s objectives. Approach vendors to request demos and gather feedback from current users about the software’s performance and suitability. Funds must also consider the long-term impact of their software solution. The best solution serves today’s compliance and reporting needs while anticipating future changes in regulations and operations. Investing in elastic and scalable software helps hedge funds position themselves in this dynamic financial landscape.

Conclusion

Hedge fund audit software plays a critical role in providing effective fund management in any regulatory environment. Hedge fund managers can navigate the complexities of their financial landscape if the software automates compliance procedures, improves data integrity, and enhances risk management. Increasing calls for transparency and accountability make robust audit tools even more important. By investing in proper audit software, hedge funds improve compliance and boost investor confidence. This leads to long-term success and market competitiveness.

FAQs

It is specialized software used by hedge funds to perform auditing functions automatically. It helps ensure transparency and compliance. The software collects data for analysis, reducing the risk of human error. This streamlines the entire audit process.

It provides data accuracy in input through automation, real-time analysis, standardized templates for reports, and full validation of the data. All these ensure that all hedge fund financial reports are accurate and consistent.

Without this software, hedge funds would face more errors in financial reports, compliance issues, and inefficient audit processes. They would also lose investor confidence and become more vulnerable to data security risks.

Reputable hedge fund audit software protects sensitive financial data through strong data encryption, access controls, and regular security updates. It also maintains audit trails and ensures compliance with industry standards. These features work together to safeguard data and meet regulatory requirements.