Software for Hedge fund accounting teams

Hedge fund accounting software is meant to address hedge funds’ unique financial needs. It follows complex deals, tracks numerous investment activities, and checks current income and expenses closely associated with a hedge fund. This function usually focuses on easing the complexity around accounting, which may be achieved by automatically generating accountancy-related financial reports and creating detailed statements following performance metrics.

The most essential features of hedge fund accounting software are accuracy and organization. With the number of transactions a hedge fund deals with, account tracking can be done manually, but one may be too slow or more likely prone to error. An automated accounting system will confirm all your financial data are being processed completely, with minimum errors, and for you to achieve real-time insights about the economic health of a particular fund.

Hedge fund accounting software confirms compliance with financial regulations. It tracks all suitable financial activities, allowing funds to stay legal and current with requirements. This smooths the process and decreases the chance of non-compliance, penalties, or legal issues.

Key features:

- Modify the tracking of financials, such as income, expenses, and fees.

- It gives out financial statements like balance sheets and profit & loss reports.

- It confirms that accounting standards are followed.

- Manages fund reconciliation by calculating what occurs in the records versus the transactions.

Hedge fund

Hedge funds are special investment funds for the rich and massive institutions meant to implement big profits using highly complex techniques. Unlike other funds for investments, hedge funds can be allowed to invest in multiple types of assets using tools such as borrowed money or trend reversal to gain extra income while involving risks and having to be well handled. To simplify this, hedge funds use special software that monitors money, manages risk, and verifies that the overall blend is compliant with all regulatory and compliance requirements.

Hedge Fund Reporting Software

Hedge Fund Reporting Software helps produce extremely long reports detailing a fund’s performance. In other words, it gives a clear picture of how the fund performs over time and keeps the investor well-informed of the strategies used in investing and the risks taken.

Key Features:

- It provides real-time data on performance.

- It generates reports on the fund specifically for investors or stakeholders.

- Data visualizations also come in the form of graphs and dashboards.

- It also tracks the risk exposure and compares it with the available benchmark.

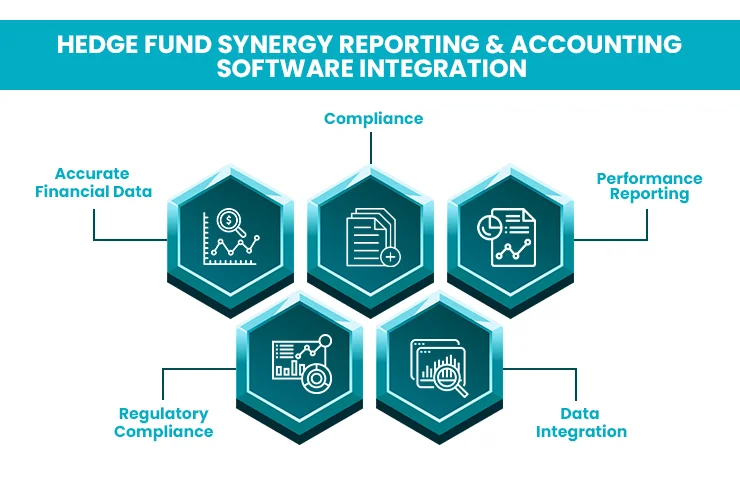

How Do Hedge Fund Reporting and Accounting Software Work Together?

Although Hedge Fund Reporting Software and Hedge Fund Accounting Software are distinct tools, they complement each other. Here’s how they work together:

Accurate Financial Data:

Hedge fund accounting software tracks the fund’s financial transactions. This data is necessary for reporting software to give the right report on performance. Reporting software can only provide information regarding the developments if the accounting is accurate.

Performance Reporting:

Although the accounting package is responsible for correcting financial records, reporting packages extract this data and make it easy to read. Investors and managers use such reports to evaluate the fund’s performance.

Regulatory Compliance:

This confirms that the fund is following the financial regulations of operation; both types of software give information on compliance by accounting and reporting on the mode in which the transaction was conducted.

Data integration:

Most hedge funds today run integrated systems. Accounting and reporting software are set up in a way that integrates data seamlessly. One will. Therefore, only a few errors, not to mention the considerable time saved since financial transactions simply go straight into performance reports.

The Importance of Hedge Fund Management Software for Better Decision-Making.

In the world of hedge funds, when the pressures are fast-paced and high-risk hedge fund management software is the right tool for hedge accounting consultants and services. Hedge fund management software provides authentic and timely data to help well-informed decisions, allowing funds to predict their performance far more reliably and facilitating daily activities for smoother management and better outcomes. This software earns investors’ trust through clear understanding and real-time reporting, keeping fund managers ahead in such a competitive market.

Profit of Using the Best Hedge Fund Accounting Software and Hedge Accounting Services for Reporting.

Productivity:

Hedge fund software speeds up report preparation by automating account processes. Investors’ or shareholders’ financial details can be obtained with a few buttons.

Accuracy:

The software ensures that all transactions are followed so there is less chance of mistakes in financial statements and reports.

Transparency:

More precise, better reports, due to accurate financial data, increase trust and, therefore, understanding from investors and other stakeholders.

How to Pick the Best Hedge Fund Reporting Software

The right software for hedge fund reporting is critical to effective management. With such software, one can streamline hedge fund operations, comply with the required reporting, and get accurate data for making important decisions. Discussing some simplified steps for easy selection of the best hedge fund reporting software.

Step 1: Determine the Hedge Fund’s Needs

First, try to establish the uniqueness of your hedge fund. Each hedge fund has special requirements: performance monitoring, risk management, or adherence to specific regulations. When you analyze the unique needs of your hedge fund, you can find reporting software that includes real-time analytics, portfolio monitoring, and automatic report generation. That will give you much-needed time to make the right decisions.

Step 2: Agreeing to Your Current Systems.

Confirm the compatibility of new reporting software with the current systems. Checking the software against the current management tool for such things as accounting software or CRM systems will avoid problems such as data mismatches and entries by a person. Integrating-capable software, such as APIs, smoothens the transition and avoids unnecessary reconfiguration.

Step 3: User Friendliness

It should be user-friendly so that your team can adapt and start using it without much time in training. The interface should be easy to navigate and simple to learn, requiring minimal time for training. The software provides support resources, regular updates, and a clean design to promote your team’s work productivity without a steep learning curve.

Step 4: Customization

Customization is crucial for hedge funds, as it allows for tailored reports based on specific metrics or formats. Software that enables customizable dashboards and workflows provides flexibility, aligning with the fund’s strategy and goals. You can set KPIs and parameters to ensure the software integrates seamlessly into your operations.

Better Compliance and Automation

Good hedge fund reporting software also allows better compliance through automation. Automated solutions eliminate most manual entries and accompanying errors, giving analysts enough time to focus on strategic activities rather than repeating data collection exercises.

The Role of Accurate Reporting in Hedge Fund Success

Accurate reporting is the role played in the success of a hedge fund.

Reporting in hedge funds has two vital aspects: regulatory compliance and investor relations. Investors rely on funds for quality financial reporting to grade how the fund is performing and evaluate the risk profile. Such reports can be assured with the best hedge fund accounting software. With the right software, funds will be able to generate accurate and transparent reports that shall enable investors to have sufficient trust in their investment decisions. Compliance with financial regulations also saves funds from penalties and negative reputations in the market.

Good data and reporting also inform fund managers of their investments’ performance and help them make better decisions. Managers can make on-the-spot strategic changes because of real-time transparency into the fund’s financial health, making the fund more agile and adaptable to changing market conditions. That is why the best hedge fund accounting software will help operational efficiency and regulatory compliance, thus allowing funds to accomplish more reasonable performance and increase investor confidence.

The best Five Hedge Funds accounting software

Hedge fund software requires the best tools to handle even the most complex financial operations. Five key players in the hedge fund market are Hashmicro, Alluve, Fund Count, Backstop, and Toggle. They all have strong hedge accounting software that can simplify reporting, enhance compliance, and optimize portfolio management. These software provide unique features and capabilities that help hedge funds meet their multiple needs in terms of performance, making informed decisions, and truly undertaking proper financial management.

HashMicro

HashMicro offers hedge fund management software as an end-to-end product, which suits the complexity of hedge fund operations through accounting software. It consists of portfolio management tools, performance measurement, and auto-reporting.

Allvue

Allvue is at the forefront of investing in management software, particularly for hedge fund accounting. Its products are designed and made according to the needs of hedge funds, private equity companies, and other investment managers.

FundCount

FundCount is a complete accounting and reporting software for hedge funds and private equity companies. It integrates accounting, investment management, and reporting in one place.

Backstop

Backstop delivers specialized software to the alternative investment sector and is one of the best software designed for hedge funds. Their solutions facilitate operations, effective reporting, and compliance improvements among investment managers.

Toggle

Toggle is a relative newcomer to the hedge fund software space. According to the company, it is an accessible platform to help hedge funds simplify complex workflows, accounting, and reporting processes.

Final thought

Accurate reporting and efficient management of today’s fast-paced financial world necessarily call for hedge fund accounting software. Such platforms assist the fund manager in enhancing transparency and associated customer trust by automatically taking out key accounting tasks, providing real-time portfolio insights, and ensuring regulatory compliance. In addition, many hedge fund accounting solutions integrate risk management features or operate seamlessly alongside dedicated hedge fund risk management software. This combination empowers funds to keep their financial books accurate and identify and control risks, which means investment safety and work above all things in unstable markets. Lastly, hedge fund accounting and risk management software work together to give a clear picture of the health of one’s financial aspect of the fund, facilitating proactive decision-making and increasing resilience in uncertain times.

FAQS

1: What trading platforms do hedge funds use?

Hedge funds work on their transactions through different platforms such as Bloomberg, Eikon, and Quant Connect.

2: What is hedge fund accounting software?

Hedge fund accounting software is specially designed for financial reporting, performance tracking, and compliance for hedge funds.

3: How does hedge fund accounting software improve reporting accuracy?

It amplifies reporting accuracy since it automates data integration, reconciliation, and calculations, thereby avoiding human error.

4: What are some best practices for effectively using hedge fund accounting software?

Some best practices are regular training, accurate data, compliance, and automated features.