Introduction:

Hedge funds and asset management are complex and challenging for investors and hedge fund managers. Traditional methods of managing larger capitals were tedious and tricky tasks; however, as the financial landscape evolves, it has transformed into a dynamic system. This shift has made way for Hedge Fund SaaS Solutions, enabling accurate financial planning, proactive risk management, and collaborative decision-making that help managers and brokers streamline their work effectively.

Managing funds and assets has always been a complex and challenging task for investors and fund managers. In the past, managing capital was tedious work. However, in the modern era, the financial management landscape has undergone a significant transformation. It now features a dynamic model that includes accurate financial planning, real-time reporting, proactive risk management, and collaborative decision-making. Advanced technology and software have played a crucial role in this evolution.

A hedge fund is a partnership of investors who accumulate or create a pool to invest in different strategies, assets, or currencies to gain average returns. In some instances, not the investors but friends and family hedge fund pools are created to use that capital amount for different investing opportunities. Different hedge fund managers use the pool of hedge funds on various markets and assets to gain profit.

In today’s modern world, many hedge fund technology platforms are available. These include hedge fund SaaS solutions, compliance software, CRM software, investment management software, and risk management software. Additionally, AI-powered fund management software is becoming more common. These tools make it very convenient for managers to perform their tasks efficiently. They help reduce risks and improve overall performance.

Hedge fund managers have a significant task to manage, secure, save, and get profit from the hedge funds, and at times, they need to report hedge funds as well if the pool gets dispersed. There comes hedge fund management software to reduce the workload for hedge fund managers.

Hedge fund management software:

It is a specialized software solution designed to assist hedge fund managers in automating and streamlining various operations to manage capital. Significant features like tracking performances of funds and assets markets, execution of trades, compliance regulations, providing real-time market insights, reducing risk ratio, and various others make the management more efficient and convenient for the managers.

It is a vital software as it offers seamless and automated integration between trading tasks, manages the risk, reduces the risk ratio, maintains compliance and accountings along with regular reporting and updates. It also maintains transparency and efficiency in reporting.

Hedge Fund SaaS Solutions:

Hedge Fund management software can be presented in the form of yet another revolutionary SaaS solution. In recent times this trend has become really popular because of its benefits and features. It offers enhanced flexibility, reduced the need for seed funding and scalability-like options to the users to get the best experience.

Hedge fund SaaS solutions are specialized management software as a service (SaaS) platforms that assist investors and fund managers in analyzing performance, creating portfolios, and automating workflow. It is cloud-based software accessed via the internet rather than installed on-premises, i.e., on local servers. It provides consumers with its premium features and options in exchange for a monthly or annual subscription fee.

Key Features and Investment Strategies:

Here are some vital investment strategies in hedge fund SaaS solutions, including quant and risk-adjusted strategic planning and execution.

- Performance Updates:

Hedge fund SaaS solution provides real-time performance updates to the managers, notifying them when and where to invest and gain more return.

- Tools for portfolio creation: This software also contains advanced tools for managing and creating portfolios, which are essential for asset allocation and diversification.

- Risk and performance management: These Hedge fund SaaS solutions provide real-time monitoring of portfolios by advanced analytics and keep track of risk metrics, including Value at risk VAR, stress testing, and scenario analysis. It improves trade execution and enhances order management to increase the growth of profits.

- Compliance and Reporting: Hedge fund SaaS solutions have completely complied with legal systems’ regulations and policies. Regulatory reporting, investor communication, and compliance features in SaaS solutions have always been highly customizable according to jurisdictional requirements. For example, a multi-strategy fund with various asset classes might need more sophisticated compliance checks than a single-strategy equity fund.

Hedge fund SaaS solutions automate transaction processing and regulatory reporting, which includes FATCA, AIFMD, Form PF, etc. The software also contains advanced compliance tools like KYC (Know Your Customer) and AML (Anti Money Laundering). Along with all these tasks, it maintains audit trails and keeps a track record of transparency to prevent future penalties.

Integration with external Data Sources:

Hedge fund SaaS solutions integrate cloud-based data with external data sources, including market data feeds and trading platforms. It collaborates with third-party data providers, allowing the funds to ingest and process customized data in their workflow. This feature assists the managers and investors to remain aware and updated about market performance, ups and downs and give them a benefit to make correct decisions timely. SaaS solutions also support multi-asset classes, instruments and real time data aggregation options which allow the user to track market performance and avoid risks.

SaaS solution and Customizations:

Customization features are often built-in in many hedge fund SaaS solutions according to workflow strategies.

- Strategic-specific modules: There are strategy-specific modules and customized designs or templates according to different fund strategies. For instance, quantitative funds might require more advanced and updated data analytics, backtesting tools, and algorithm trading options; on the other hand, short equity funds acquire accurate portfolios and risk management with better performance attributions.

- Customized templates for Dashboards: Hedge Fund SaaS solution offers a variety of customized templates, display options and dashboards which is essential for displaying metrics according to the strategies. For market neutral funds, the correlation metrics and beta exposure is significant. However, event-driven funds may track specific actions or new sentiments or triggers. The dashboard notifies the users with alerts and notifications to keep them updated. The dashboards can also be tailored or customized to track key performance indicators (KPI) such as risk-adjusted returns or liquidity constraints depending on fund strategy.

Cloud-based model

Hedge fund SaaS solution is popular due to one of the major reasons for being a cloud based platform. The cloud-based nature allows easy scaling, data integration with several external data sources, tools and updates. It provides users with real-time software updates, with being a cost and time-saving software. It also gives hedge funds the flexibility and efficiency to adjust the software as fund strategies require. Cloud-based model also allows the strategies and plans to improvise and evolve as new updates arrive.

- Customer Relationship Management and Reporting: Hedge fund SaaS solutions feature automated investor and customer reporting, including performance summaries, NAV esports, and fund statements. The portal in SaaS solutions gives investors access to real-time account information updates and fund performances.

- Back office working and accountings: Hedge fund SaaS solutions perform automated net asset value (NAV) calculations that save time and reduce costs. It also makes sure to perform distribution management and capital calls. Hedge fund SaaS solutions also perform various fee calculations, including managing and performance fees.

- Cloud Security and Privacy: Hedge fund SaaS solutions keep the cloud secure and protected against all bugs and viruses. It ensures the users that their private and confidential information remains encrypted and safe from cyber threats and misuse. It also provides firewalls, creates regular backups, and a disaster recovery plan to maintain business continuity.

- Collaboration Tools: These essential tools in hedge fund saas solutions allow the collaboration of hedge funds with strategies, trades, and reports for multiple users.

The exponential growth of Hedge fund SaaS solutions proved beneficial for all investors and users managing hedge funds.

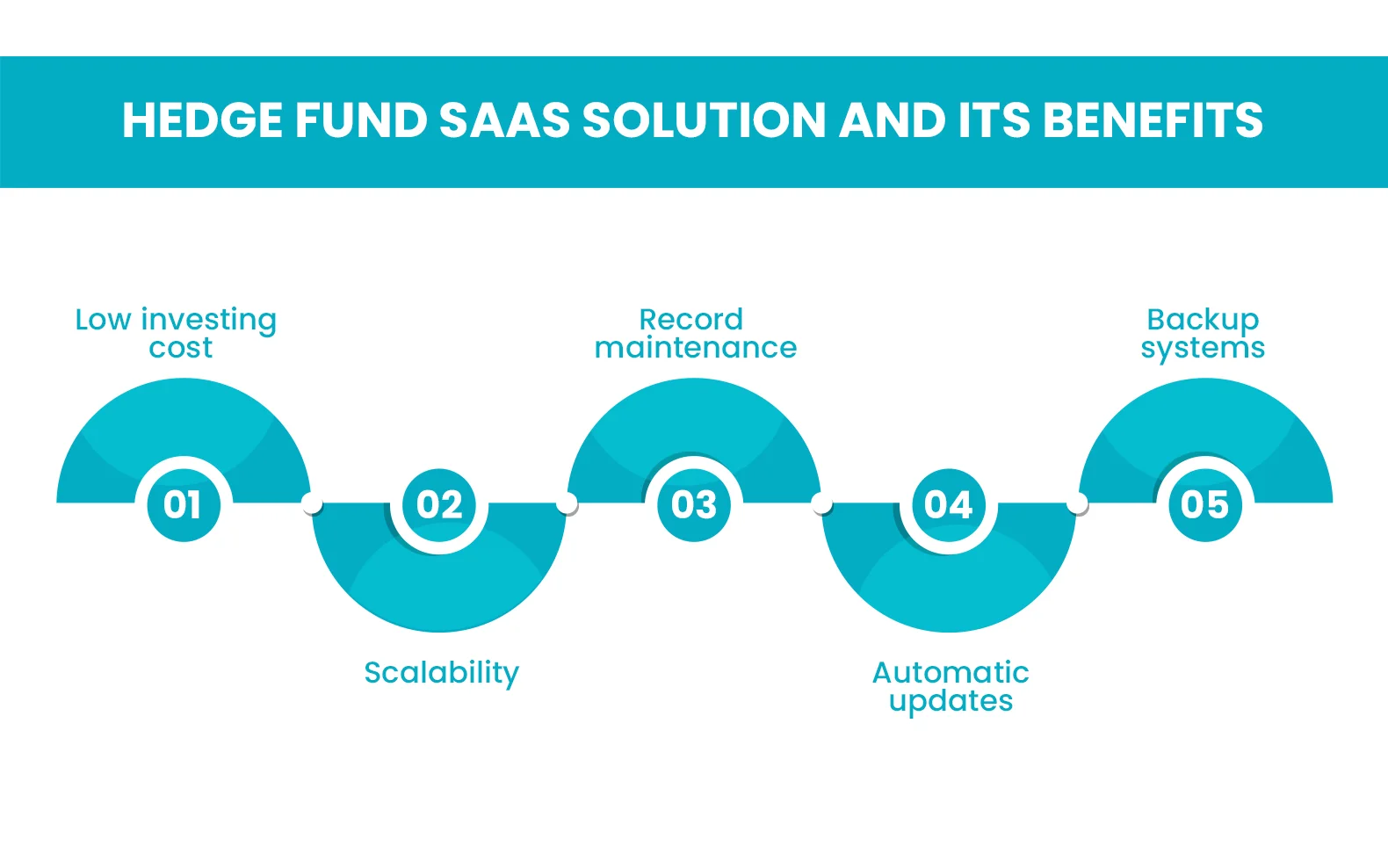

Advantages of Hedge fund SaaS solutions:

Decreased investment costs: The SaaS solution is basically a subscription-based model, which does not require massive seed funding from hedge funds in hardware, neither for software licensing nor for attractive and strong IT infrastructure. This is a big advantage for small businesses and new hedge fund managers, and brokers who lack big resources or huge capital for such expenses.

Scalability: Gradually, the hedge fund grows and requires additional capacity, portfolios, users, and features. The SaaS solution takes care of it by being a scalable software. The cloud-based infrastructure allows funds to expand their platform usage with a better server capacity and no need for extensive IT resources.

Record maintenance and backups with automated updates: With regular updates, SaaS solutions relieve the workload on hedge fund managers of managing updates, patches, or new upgrades. Along with it, the record and backups are also regularly maintained and updated to make the users get the latest features, compliance tools and security benefits.

SaaS platforms perform software updates regularly and maintain such records so that hedge funds do not have to manage updates, patches, or upgrades in-house to ensure users can get the latest features, security enhancements, and compliance tools.

Backup Systems and Disaster Recovery Mechanisms: Cloud-based SaaS solutions typically have a built-in backup system and disaster recovery strategies and mechanisms to prevent any data loss, and this mechanism also protects the continuity of a business. This is very beneficial to ensure that hedge fund data is safe even in a disaster, as it is regularly backed up as a safety measure.

Accessible platform: SaaS solutions follow a cloud-based model, which enhances its accessibility, that is, a user can access the SaaS solution from anywhere in the world through any electronic device connected with the internet. This gives the traveling hedge fund teams the advantage of accessing data from remote locations. It also assists portfolio managers in getting access to real-time data in remote work. Overall cloud-based approach has increased the SaaS solutions’ accessibility, productivity, and collaboration

Other SaaS Solutions:

Furthermore we can talk about some popular names of hedge fund management SaaS solutions:

- Enfusion: It is a hedge fund management SaaS platform of cloud base in nature, which is widely used for portfolio and risk management. It is widely known for its integration across all three operations, i.e., front, middle, and back office operations. It also has other features like real-time data analytics and attribution tools.

- Eza Software: It offers an order management system (OMS) and portfolio management tools with a cloud-based approach, providing scalability and accepting multi-asset classes.

- Geneva: A leading SaaS solution for hedge fund accounting, reporting, and performance analytics. It provides real-time fund accounting and risk management features with cloud deployment options.

- SimCorp: SimCorp Dimension is another cloud-based solution that performs hedge fund portfolio management, trading compliance, and accountancy. It is highly famous for its advanced risk management capabilities and enterprise-level scalability.

Talk about one of the most popular SaaS solutions for hedge fund management.

Enfusion Investment Management Software:

It is a global provider of cloud-based software solutions for hedge funds and other asset management industries. It primarily serves hedge fund managers, other asset managers, brokers, private equity firms, and other professional investors by offering features like portfolio management, risk analysis, and back-office operations.

- Services and products by Enfusion:

Enfusion investment management offers many services and products. However, a few of them are mentioned below.

- Portfolio Management:

Enfusion provides a real-time platform that allows investment managers to track, manage, and optimize their portfolios. This includes capabilities for portfolio construction, performance attribution, and reporting.

- Trading Execution Strategies:

Enfusion offers trading and execution solutions that assist investment managers in performing their tasks seamlessly and placing and managing trades across multiple assets such as equities, fixed income, etc.

- Risk Analysis and Management:

Enfusion investment management software offers integrated risk analytics that allows consumers to monitor and track any threat or risk in portfolios, along with stress testing, scenario analysis, and Value at risk (VAR).

- Middle and Back Office Operations:

It offers solutions for operational efficiency, like trade reconciliation, accountancy, and compliance reporting. This software automates many back-office tasks and operations to streamline operations and reduce the risk ratio.

- Cloud Based Architecture:

Enfusion platform consists of cloud-based technology that provides scalability, flexibility, and secure access all around the globe. This architecture helps investment firms to tackle the complexities of on-premise infrastructure and decreases the cost of ownership.

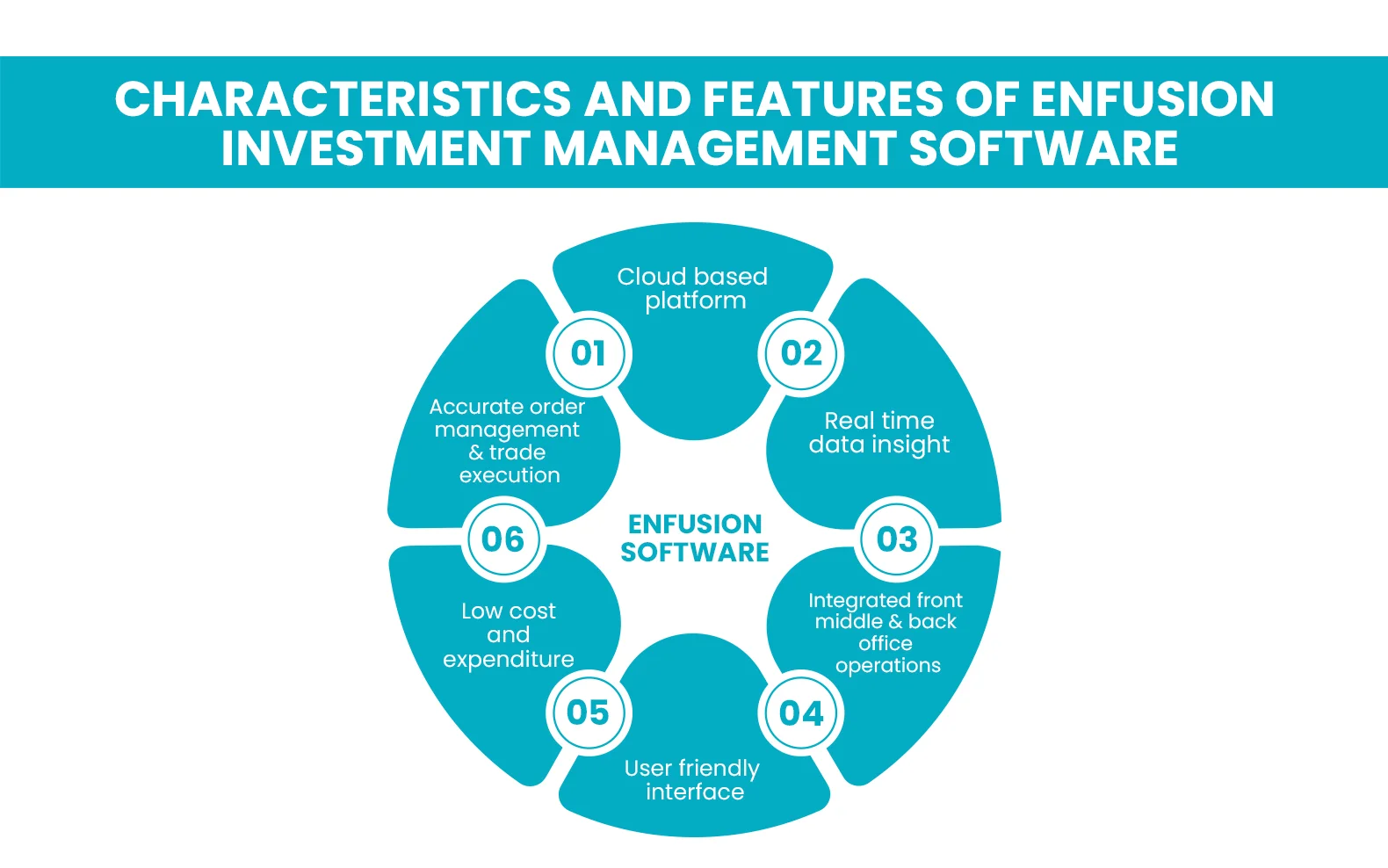

Key Characteristics of Enfusion SaaS solution:

Cloud-Based platform:

A basic characteristic of Enfusion is that it is a cloud-based software that allows investment and capital managers to access their data anywhere in the world through an internet-connected electronic device. Along with remote access, it makes Enfusion very flexible and scalable software, enabling users to stay connected and work across different time zones.

Real-Time Insights and Data Info:

Enfusion gives users real-time updates, trading insights information, portfolio tracking, performance analytics, and risk metrics to keep investment managers alert in making quick decisions. Enfusion aggregates data from multiple sources and gives users an upper hand with such information.

Integrated Front, Middle, and Back Office Operations:

A key characteristic of Enfusion is its integration with all types of operations.

- Front office: It supports trade execution, portfolio creation, management, and risk management, allowing investment managers to make real-time trading decisions and gain more profit.

- Middle Office: It helps monitor the risk, maintain compliance, maintain the integrity of portfolios, and adhere to investment policies and requirements.

- Back Office: this includes different tasks like reconciliation, managing accountancy, calculations of fee and investor reporting streamlining the administrative processes and reducing manual errors.

Enfsuion performs these tasks during front, middle, and back office operations.

- Save Overall Costs: With a subscription-based model, Enfusion eliminates the need for significant upfront seed funding and expenditures in hardware, software licenses, and IT infrastructures. The client must pay the monthly or annual subscription fee based on his requirement for the premium features and options. The cloud approach also makes it easier to lose all the operational burden on IT teams because Enfusion performs system maintenance, updates, and scalability.

- User-friendly Interface and Customized Dashboards: The platform features a user-friendly interface. It includes customized dashboards and various reporting tools. This design helps investment managers conveniently access the required data, information, and insights. Enfusion’s reporting features are robust. They enable the generation of detailed performance, compliance, and risk reports. This provides transparency to both internal teams and external investors.

- Accuracy in Trade Execution and Order Management: Enfusion includes a trade execution management system. It supports multiple asset classes and facilitates order routing and trade lifecycle management. Seamless and accurate trade execution occurs through direct market access. The platform also integrates with third-party tools, trading venues, investment managers, and brokers.

- Performance Attribution in Enfusion Software: Enfusion’s performance attribution provides detailed insights. It evaluates which trades, sectors, or strategies contributed to returns and which led to losses. Attribution analysis helps investors understand performance dynamics. It also assists in predicting future investment outcomes. This allows managers to make informed decisions accordingly.

Benefits of Enfusion investment management software:

Enfusion offers firms and capital managers to improve their operational efficiency, reduce costs, and many more advantages, which are discussed below:

- Operational efficiency:

It automates many of the front-to-back office tasks, which reduces the need for manual interventions, minimizes the chance of errors, and accelerates decision-making, saving time and improving overall operational efficiency.

- Scalability and Flexibility:

With the cloud-based approach, Enfusion is a scalable and very flexible software for hedge fund management, scaling operations, accepting new strategies, and handling a growing number of portfolios, trades, and investors easily.

- Real-Time Insights:

It gives users real-time access to the data, and analytics empowers them to make and correct trading decisions and execute them. The ability to track performance, manage risk, and execute trades in real-time is significant for fund investing managers in this fast-paced trading world.

- Regulatory Compliance:

For funds management, software like Enfusion must comply with regulatory bodies and adhere to its policies to ensure the user is safe from heavy penalties and fines after the audit. It simplifies all these processes using tools for compliance reporting, risk management, and audit trails.

- Enhanced Transparency:

It provides clear and transparent access to reports to the internal stakeholders and external investors to maintain trust and transparency. This strategy strengthens the relationship with investors by offering detailed insights into fund performance and operations.

Conclusion

Hence, Enfusion investment management is a leading and highly popular SaaS solution for hedge fund management and other asset management firms. It offers fully integrated software, especially for portfolio creation and management, risk management, and back-office operations. Enfusion is a cloud-based software, so all these capabilities on a cloud make it even more famous among remote investment managers and traveling brokers, which makes it more scalable and flexible with enhanced operational efficiency. The cloud-based approach has also reduced operational complexities, allowing managers and investing firms to focus on gaining more profits.

FAQs

Hedge fund SaaS solutions must have a cloud-based approach and data integration, provide performance updates, contain tools for collaboration, and have customized dashboards. It should also perform risk analysis and trade execution along CRM.

It ensures regulatory compliance by regulatory reporting, including FATCA, AIFMD, Form PF, etc. It also contains advanced compliance tools like KYC (Know Your Customer) and AML (Anti Money Laundering).

Yes, it is customizable for different fund strategies, along with a customizable dashboard and strategic modules.

SaaS solutions with a cloud-based approach reduce the investing costs and provide scalable software with global accessibility and interaction with external data sources and third-party tools.

It can be integrated with third-party collaboration tools and external data sources.