In hedge funds, observance of Know Your Customer compliance is not merely a gesture of legal compliance but a strategic business approach to protecting integrity and future business. This is especially so because hedge funds usually involve high-value transactions and are sometimes manned by discerning customers in the form of high-net-worth clients. The investments being global, the issue beckons for deeper investments in proper KYC compliance solutions. Hedge fund KYC software simplifies and automates investment identity verification while confirming compliance with all regulations and minimizing risk factors related to financial crimes. This article examines why KYC software is so important, how it plays a massive role in hedge fund compliance, and how having the right hedge fund KYC software might help your business avoid risks.

What is KYC Compliance Software?

Know Your Customer (KYC) is an indispensable financial service procedure required in hedge funds. It involves verifying the identity of a client or investor involved in any business to prevent fraud, money laundering, and financing of terrorism. Its aims include assuring hedge funds that they engage with genuine investors and do business with the right people.

The general principle behind hedge fund KYC software is to automate and ease the process of information gathering and verification on clients. This would range from personal details and identification documents to biometric data. Many compliance software for hedge funds integrates AML procedures, wherein hedge funds can monitor transactions for suspicious activities and maintain compliance with local and international regulations. This has, therefore, made KYC verification turn out to be primarily an online process, which forms much of the shift within the digital age, even as hedge funds need to adopt comprehensive hedge fund KYC software solutions that are not only effective but also scalable and handle the rising volume and complexity of client data.

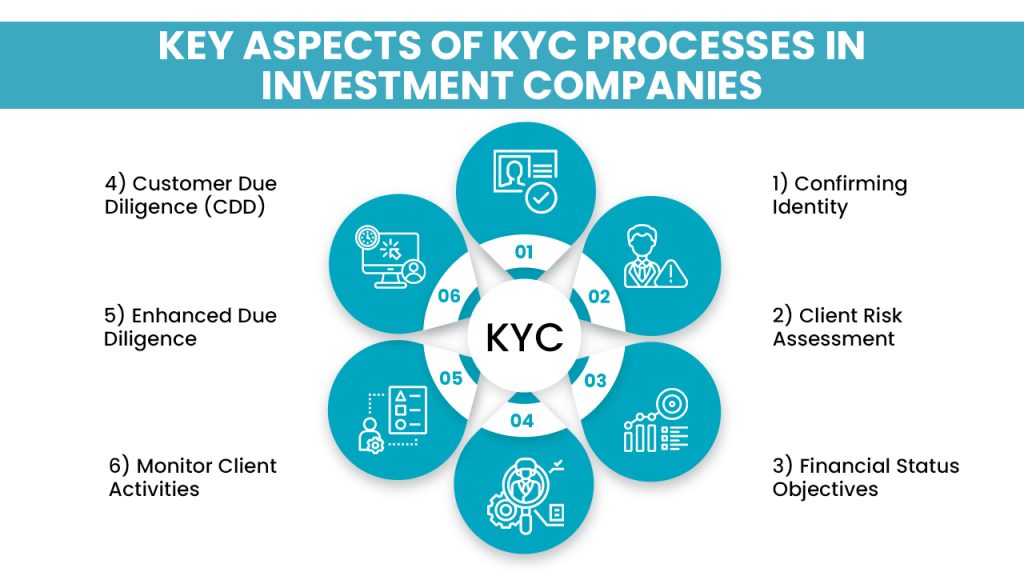

Key Aspects of KYC Processes in Investment Companies

General features of KYC processes for investment firms include the gathering and validation of a client’s identity through a multi-step process: gathering data from the clients, verification of identification documents, and data collection regarding the history of each investor in terms of financial issues. Altogether, this is an all-embracing process that has several key aspects

Key Elements of KYC Procedures in Investment Firms

- Confirming Identity: Investment firms must validate each client’s identity using government-issued passports or any other reliable form of identification. This will eliminate fraud cases and prove the customer is free from criminal activity.

- Client Risk Assessment: Following the client’s confirmation, the firm will assess the risk level attributed to each client. This is critical for most hedge funds since they usually deal with high-net-worth individuals or entities with complex financial backgrounds. The assessment considers the source of the investors’ wealth, location, and whether they are politically exposed persons (PEP).

- Financial Status and Investment Objectives: A hedge fund needs comprehensive details of its client’s financial status, covering income level, investment objectives, liquidity needs, and risk tolerance. This enables the firm to formulate an appropriate investment strategy consistent with the objectives that its fund is expected to serve.

- Customer Due Diligence (CDD): This is general due diligence carried out through ascertaining the basic information about a client to determine the level of risk presented. It includes confirmation of personal details, verification of financial status, and ensuring that the investor’s funds derive from a verifiable source.

- Enhanced Due Diligence: When the risk assessment indicates higher concern, investment firms must conduct Enhanced Due Diligence. This involves deeper investigations, including client business relationships, background checks, and additional financial documents. It is particularly necessary for high-risk clients, such as PEPs or those from jurisdictions with weak AML regulations.

- Monitor Client Activities: Hedge fund firms must monitor client activities for potential illegal behaviors by tracking transactions for unusual patterns. Continuous monitoring helps detect activities like money laundering or terrorism financing and ensures compliance with relevant regulations.

The Role of KYC in Hedge Fund Compliance

For hedge funds, the use of KYC software extends beyond regulatory compliance. With KYC procedures in place, hedge funds confirm they are not unknowing participants in illegal activities such as money laundering or financing terrorism. This is important since hedge funds handle huge sums of capital and are viewed as holding powerful investors. Lack of proper due diligence on KYC leads to heavy financial fines, a tarnished reputation, and criminal charges.

KYC and Money Laundering Prevention

Money laundering is important for hedge funds since illegal money may pass through the firm. Through intense KYC checks, hedge funds can ascertain the source of their client’s wealth, hence ensuring legitimate sources. Through hedge fund KYC software, one identifies high-risk clients who may attempt to use a hedge fund for money laundering. For example, when a hedge fund investor provides false information or submits fraudulent documents, the firm could detect these through its KYC process, deny an investment, or flag the account for further investigation.

KYC and Counter-Terrorist Financing (CTF)

Apart from money laundering, hedge funds must also be very watchful of the chance of financing terrorism. KYC solutions and company procedures are essential as they help identify clients connected with terrorist organizations or involved in suspicious financial transactions. Therefore, by adhering to KYC regulations, hedge funds decrease the risk of contributing to terrorism financing and ensure compliance with international anti-terrorism laws.

How KYC Protects Hedge Funds and Investment Companies

Implementing KYC procedures offers various hedge funds and other companies an extremely attractive set of benefits.

- Regulatory Compliance and Risk Mitigation: Through KYC, hedge funds ensure compliance with all local and international regulations, including anti-money laundering, anti-terrorism funding, and fraud prevention regulations. Thorough KYC checks, therefore, mitigate the risk of regulatory penalties and fines.

- Strong Investor Confidence: The investor will trust hedge funds that are keen on securing the investor’s wealth and strict compliance regulations. A painstakingly carried-out KYC process emboldens one with the confidence that your capital is in the right hands.

- Prevention against Frauds: With the help of KYC software and, at the same time, manual due diligence, fraudulent actions may not occur since such can include identity theft or false investments. In hedge funds, even with very robust KYC protocols, fraudulent actors will not have the opportunity to cause harm before being detected.

- Reputation Protection: Breach of KYC solutions company rules or failure to prevent money laundering or financing of terrorism may severely damage the reputation. A strong process for KYC might protect the reputation of such hedge funds and arm them with a reliable and trustworthy track record.

- Investment Strategy Tailoring: KYC procedures will ensure compliance and help firms better understand investors’ financial situations. This will help a hedge fund tailor investment strategies that fit the client’s financial needs, risk tolerance, and liquidity requirements.

Importance of a KYC Provider for Partnering

As compliance in KYC is complex and based on regulations, hedge funds outsource these challenges to specialized KYC solutions providers. Working with a good KYC solutions company services provider will assure you that your hedge fund will have updated compliance tools and resources and that the hedge firm can focus on managing investments.

The offering ranges from implementing KYC software for banks to working with cryptocurrency-based KYC providers on digital assets and partnering with a third-party KYC provider specializing in international clients. Thus, hedge funds can tap into a provider’s expertise and technological know-how while reducing non-compliance risk and enhancing operational efficiency and the overall client experience.

Corporate KYC: The New Key Element of Concern for Hedge Funds

While individual KYC procedures would try to verify individual clients’ identity and financial background, business entities like corporations, partnerships, and trusts would have corporate KYC. Corporate KYC is especially vital to hedge funds that pertain to institutional investors or clients since corporate KYC verifies the legitimacy of the corporate entity and provides an understanding of the potential risks associated with the business structure and its operations.

Corporate KYC is usually much more complicated than individual KYC because it requires understanding the business’s ownership structure, identifying who owns or controls the company, and confirming the actual beneficial ownership. Hedge funds must assess a business’s legal standing, source of funds, and its relationship with other entities in the financial ecosystem.

Blockchain and KYC: Playing into Distributed Ledger Technology for Trust

Blockchain-based KYC solutions fill the need for hedge funds to conduct cryptocurrency trading or plan entry into digital assets. It’s what stands behind blockchain technology as a new layer of transparency and the obscurity that the KYC process might appreciate.

By adopting crypto KYC providers, hedge funds can verify the identity of investors in the cryptocurrency ecosystem. The blockchain’s immutable nature means that once data records, it cannot be altered, thus providing a high degree of certainty regarding the integrity of the process involved in confirming identity. This is particularly important in an organization like cryptocurrency, where the nature of transactions performed is anonymous and extremely susceptible to misuse. DLT allows investors’ KYC data to store and share safely among the parties involved in the investment process, keeping the investor’s identity private. It reduces data breaches and increases security, enabling hedge funds to validate clients across multiple platforms without repeatedly collecting KYC information from the fund or its client.

AI and Machine Learning in KYC: Predicting and Mitigating Risk

AI and machine learning are rapidly changing the compliance landscape in financial services. In hedge funds, the next-level development – AI-powered machine learning KYC software in client verification capabilities – propels this industry into a new echelon.

Further, AI-based KYC systems can flag possible future risks by identifying unknown fraudsters and authenticating a customer’s identity. They do this by analyzing large datasets and recognizing patterns in client behavior that could be suspicious before they are perpetrated. It’s not unusual for subtle adjustments in the source of funds or other financial inconsistencies to escape human analysts but be caught by machine learning algorithms.

Cross-Border Compliance: Reaching Around the World with Local Precision

One of the biggest challenges for hedge funds is dealing with the diversity of the needs of different regulations in various countries and regions. KYC requirements are not standardized, and each country has its set of regulations, documentation, and procedures for client verification. The absence of standardization challenges hedge funds, which operate globally and deal with clients from different countries and jurisdictions.

With KYC solutions with tailored, region-specific compliance features, hedge funds can manage their global client base without necessarily having to keep track of the varying regulatory nuances of every jurisdiction. This minimizes chances of non-compliance while confirming that a fund can continue its international operations without penalties.

Client Experience: Seamless and Secure Onboarding Process

In an era when investors want speed and convenience, KYC software for hedge funds is also important in boosting client onboarding. “Offends or lightens investors at the first instance” is a smooth, digital onboarding process fueled by KYC software processes. With secure digital access, clients can upload documents and verify identities in minutes rather than dealing with lengthy delays or drawn-out paperwork.

Considering this ease of onboarding, high-net-worth individuals and institutional investors expect a much higher level of service efficiency. So, in support of this, including biometric verification, facial recognition, and secure document uploading, hedge funds would be able to reduce friction and bring more customer satisfaction in this regard. Instant verification and approval can help hedge funds focus on investment management instead of bogging their clients down with endless obstacles.

Scalability and Flexibility: Anticipating Future Challenges

Prepare for the Unknown Future of Hedge Funds. Today’s time for hedge funds to prepare for an uncertain future. With regulations evolving, the advancement of financial technologies, and the ever-changing global financial crime landscape, hedge funds need KYC solutions company that are efficient for today but equally prepared for tomorrow’s needs.

Another advantage of modern KYC solutions is scalability. When hedge funds expand, they sometimes rapidly onboard thousands of clients and manage increasingly complex portfolios. Scalable KYC software thus allows the firm to accommodate these growing demands without sacrificing accuracy and quality compliance.

Adapting to this new paradigm, hedge funds can simply adapt to emerging regulations or expand into different markets with minimal operational shock. They may be institutional investors or cryptocurrency clients; it does not matter whether they are entering a new country with distinct compliance requirements; modern KYC software can grow and change in real-time, positioning the hedge fund better than competitors.

KYC is Crowdfunding vs Venture Capital or Angel Investing

KYC is a significant process applicable to crowdfunding and other conventional forms of investment, such as venture capital and angel investing. Though the principles of due diligence are uniform on all counts, including identity verification and financial stability assessment, their application differs in these investment environments.

Very often, the existing KYC and anti-money-laundering procedures from traditional investing spheres of VC and angel investing fall upon crowdfunding platforms.

Many crowdfunding teams consist of experienced teams from venture capital, angel investing, or investment banking backgrounds with best practices developed within those industries. In theory, proven frameworks from traditional investing are largely independent of the online, often international nature of today’s crowdfunding.

What Do Angel Investors Expect Before Investment?

Angel investors typically conduct thorough due diligence to verify the investment is legitimate before committing funds to an investment. Despite different requirements, angel investors typically demand the following:

- Validation of Identification Evidence That Is Owned by Either the Entrepreneur or the Founders

- Evidence That the Startup or Business Has Been Incorporated

- Business Plan: Describe the Strategy, Market Opportunity for the Business, and Financial Projections

- Profit and loss statements, plus a balance sheet if the business is operational already

- List of current supporters and information from previous rounds

- Evidence of ownership of intellectual property, such as patents, trademarks

- Agreements outlining working arrangements with staff

These due diligence checks assure the angel investor that the startup is legitimate, has a solid base, and can efficiently manage and scale the business.

What Does Venture Capital Look for?

Due diligence in VCs is more rigorous because the capital being placed at stake is significantly more than that of an angel investor. General areas that VCs typically take into account include the following:

- Corporate history and structure, including partnerships or joint ventures

- Resumes of management and key associates, as well as organizational charts

- Information on intellectual properties, pending patents, trademarks, copyrights, claims, or litigations involving intellectual property.

- 3-5 years of financial statements, apart from information on previous rounds of funding and investments.

- Legal and tax matters-including ongoing/past issues associated with income or employment taxes.

- Acquisitions, divestitures, and restructuring documents.

VCs consider it extremely important that the startup be financially sound, legally sound, and oriented for growth; hence, these checks significantly mitigate risks.

How KYC in Crowdfunding Platforms Works:

The crowdfunding version of KYC is pretty much identical to other investment platforms; however, due to the online nature of these sites, there are a few nuances here and there. Crowdfunding platforms and Lender Kit-based ones tend to make things much easier by using automated systems for investors and administrators. Here’s how it works in general about KYC:

Registration Process: When joining the portal, users-investors, whether individuals or corporations, choose the role, such as an investor, backer, or corporate entity. Some basic details, such as income size and investment preference, are captured at the time of registration.

Questionnaire: The platform will design a series of questions to ensure that the investor understands the risks. The investor will be told that their capital is at risk and that there is no guarantee for future returns based on past performance. One may lose some or all of their capital.

Data Upload: All investors shall upload personal data, which may consist of full names, addresses, and other forms of contact information. Corporate investors shall ensure to upload details concerning the organization, which may include incorporation documents such as proof of incorporation.

Upload Documents: The investor can obtain electronic copies of the required documents, including proof of identity, proof of incorporation, and proof of financial statements.

Upon submission of the form, the service will forward information to a KYC/AML Authorized Provider for verification purposes. KYC provider verification normally takes up to 24 hours. After verification, the data are therefore evaluated carefully to authenticate the investor.

Admin Review: Once the verification is done, the platform’s admin receives a notice and is now in a position to allow or not to allow the investor’s application about the checks done by the KYC/AML providers.

Differences in KYC Between Corporate and Individual Investors in Crowdfunding

While individual investors typically require less complex KYC, corporate investors are complex. Besides verifying the identity of the individual investor, KYB checks come into play when dealing with a corporate investor. This includes:

- Verification of the legitimacy of the company

- Ownership structures – shareholders and UBOs.

- Obtaining clearance from all shareholders and UBOs that the company can invest in any crowdfunding projects.

- Obtain any legal document demonstrating and upholding the company’s authorization to invest.

Vetting corporate investors is important in the case of crowdfunding platforms. This will prevent fraudulent dealings and protect a platform from risks vis-à-vis law and finance.

Crowdfunding Regulation and KYC: Adjustment to various jurisdictions

The last difference lies in jurisdictions and the corresponding regulatory requirements. Differences often vary from country to country, including investor protection requirements, financial crime requirements, and even anti-money laundering requirements where the crowdfunding platform wishes to operate. For this reason, there are a few good reasons why most of these platforms opt to work with established KYC services providers who know how to navigate most of these regulations, ensuring their platforms are compliant and safe.

Final thought:

Where risk is omnipresent, it’s no surprise that KYC software has increasingly become a must-have in hedge funds. From automating identity verification and enhancing cross-border compliance to using AI and blockchain technology for proactive risk management, these advanced tools are reshaping how hedge funds conduct due diligence, protect their business, and build trust with investors.

It is not a question of regulatory compliance but an effort toward enhanced operational efficiency, assurance of investors’ confidence, and hedging emerging threats. For hedge funds to stay competitive, reduce risks, or expand globally, choosing the right KYC software provider is vital. In the digital finance age, hedge fund KYC software is far more than a mere regulatory requirement; it can shield your hedge fund from financial crime, reputation damage, and costly fines.

FAQS:

KYC software ensures that a hedge fund verifies the identity of its investors, manages regulatory compliance, and minimizes the risks of financial crimes.

KYC ensures that money laundering does not occur, maintains compliance with regulations, and upholds investor trust. It prevents illegal financial activities by verifying the identity of investors. This process also builds trust by ensuring transparency and accountability in transactions.

KYC software ensures hedge funds remain compliant, reducing exposure to regulatory penalties through automated checks for compliance assurance of being AML compliant.

The key features include identity verification, risk assessment, watchlist screening, transaction monitoring, and automated reporting.

This improves accuracy, reduces time and costs, and boosts regulatory compliance. It streamlines processes while ensuring adherence to regulations.