The hedge fund industry is undoubtedly moving toward cloud computing as an important trend, delivering efficiencies, scalability, and cost savings. The heart of this transition will entail the need to be agile and responsive to market conditions and the sheer fact that hedge funds can no longer afford to neglect. More and more hedge funds are moving their data, applications, and infrastructure to the cloud. Hedge fund cloud security remains one of the critical concerns, as sensitive financial data is being transferred to virtual environments. For hedge funds, more stringent and complex cybersecurity practices are required to suit their particular needs. This content will inform you about some primary considerations in cloud security, compliance directives, and critical solutions to help hedge funds achieve secure cloud infrastructure.

The Cloud Security Landscape for Hedge Funds

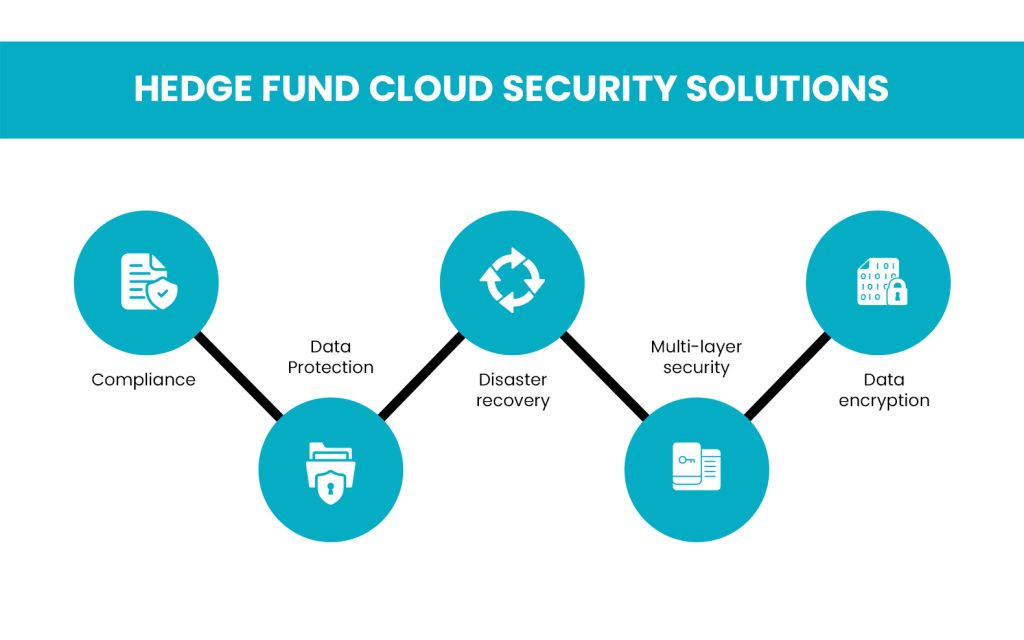

With cloud environments come the complexities of security issues hedge funds must grapple with. By and large, cloud security is a significant issue in any industry. Still, in the financial services arena, it is much more critical since the confidentiality and integrity of data assume top priority. Security breaches are expensive as hedge funds work with enormous volumes of sensitive client and proprietary information. A robust hedge fund cloud security strategy will help these concerns, providing hedge funds with tools to protect data, support compliance, and improve operational resilience.

The Cloud Security Alliance recently reiterated the need for best practices in securing cloud environments. It suggested that financial services firms embrace a “defense in depth” approach to safeguard their security. This approach includes multi-layer security, such as physical access controls in the data centers and the latest cybersecurity measures for virtual machines and networks. Cross-contamination risks from multi-tenant cloud environments, internal breaches, and external threats require implementing layered security across the hedge funds’ physical and virtual assets.

Layered Security: The Foundation in Physical Security

The data center’s infrastructure begins with physical protection provided by cloud security. Hedge funds must choose cloud providers that use Tier III or higher data centers that provide resilient infrastructure, such as multiple active paths for power, redundant cooling, and backup systems. Similarly, these data centers should be in regions with shallow risk from natural disasters since environmental disruptions can easily threaten the availability of services and data integrity.

In addition to the geographic aspects, physical security at the data center stage consists of the following:

- Surveillance through cameras that can be monitored at any time; visual verification at entry points.

- Access level follows the concept of two-factor authentication using a card and biometric scrutiny.

- Visitor access control, where the process includes logbooks for auditing and tracking of physical access.

Physical security also involves isolating servers, networks, and storage to prevent illegal access to or mixing of data belonging to various clients. This way, hedge funds’ sensitive information remains inside isolated and secure environments, reducing the likelihood of a data leak or breach.

Isolation and virtual security: Protection of the virtual space

Virtualization is the driving force behind cloud infrastructures and the pursuit of efficiency and scale. However, virtualization yields different security-related concerns to its users. In traditional infrastructures, data streams straight through dedicated physical equipment. In virtualized environments, various VMs may use the same hardware resource. Therefore, hedge funds must ascertain that their chosen cloud provider addresses all measures to isolate each VM and prevent exposure.

Cloud providers must use strict isolation protocols to isolate each client’s data, applications, and resources. Hedge funds should discuss the mechanisms preventing data co-mingling and how clients’ environments can be isolated securely. This is critical in multi-tenant cloud environments where unauthorized access to data can happen when isolation fails. Further, best practices for securing virtualized environments include:

- Network-based security controls that can identify and prevent unauthorized access.

- Protections in the form of redundant virtual networks against data loss and service disruption

- Encrypting data on inter-site transmissions satisfies the business regulatory need under regulations such as SOX and GDPR.

For hedge funds, this level of security reduces the risk of data breaches and increases confidence that their assets are safeguarded in a shared infrastructure.

Policies and Compliance: Governance and Control

Security policies would thus represent an essential part of hedge fund cloud security. Access and control of hedge funds toward assessing a cloud provider would be vital, including governance frameworks governing data protection and incident management issues. Therefore, the general policy framework to be implemented should address areas including:

Access Control Policy: Define how access to storage, virtualization, and network components is managed, including protocols for monitoring, access grants, and logging system changes.

The information security management policy describes the safeguards against breaches, response procedures in case of a security incident, and methods for reporting and resolution of incidents. It is one of the key policies in hedge fund cybersecurity solutions as it reflects the provider’s readiness to handle security events.

Employee, Visitor and Contractor Security Policy Manages and outlines the employee, contractor, and visitor screening procedures for individuals with access to sensitive systems or data centers.

This knowledge is vital to hedge funds as it is used to judge a cloud provider’s security culture. In addition, a hedge fund needs to ensure that its service provider has set protocols for training employees on these policies and frequently tests whether they are effective. Audits or an internal assessment can help determine the security vulnerability gap that needs correction.

Cloud Compliance for Hedge Funds: Compliance in Regulated Requirements

Compliance is an important component of security in cloud computing by hedge funds. The financial services companies are under intense scrutiny by regulators, such as SOX, GLBA, and GDPR. Hedge fund companies must confirm that the infrastructure and practices of a chosen cloud provider comply with these standards. The compliance standards might demand, for example,

- Data encryption protects sensitive information’s confidentiality in transit and at rest.

- Access logs to monitor who accesses the sensitive data and for what purpose.

- A steady security audit discovers vulnerabilities, and remediation steps can be taken quickly.

Non-compliance would expose hedge funds to severe fines, damage their reputation, and erode their client credibility. So, hedge funds must find and document providers with transparent compliance practices. In doing this, a robust compliance posture in the cloud will be established to satisfy the regulatory demands and client expectations.

Hedge Funds Data Preservation in the Cloud

Keeping the Integrity of the Data and Confidence in the Cloud

Data protection is an important aspect of hedge fund cloud security for hedge funds because they handle sensitive information involving individuals’ finances. To protect cloud data, hedge funds employ encryption and integrity protocols to prevent unauthorized access and data corruption. Promising strategies to protect data include the following:

- All sensitive data, both at rest and in transit, should be encrypted.

- MFA is used to limit unauthorized access to systems and data.

- DLP tools are data transfer monitoring and control processes to minimize leakage or unintentional disclosure risks.

Data backup and retention policies are also included in data protection for hedge funds. The schedule and integrity of regular, secure data backups will allow hedge funds to respond promptly to business interruptions resulting from data loss events. Hedge funds must be able to insist that the cloud provider’s backup practices support the industry standard and regulatory requirement; this would relieve a hedge fund of concerns about critical data remaining recoverable during an interruption.

Disaster Recovery Solutions for Hedge Funds

In a cyberattack, system failure, or natural disaster, hedge funds require disaster recovery solutions that continue business as usual. Hedge funds operate in volatile markets, and any sustained downtime poses an imminent risk of causing substantial financial losses. Disaster recovery solutions for hedge funds should include the following among their offerings:

- Automated backups that run frequently enough to ensure all the latest data changes are captured.

- Geographically dispersed data centers to prevent regional failures.

- Failover systems that immediately route services onto standby servers with no disruption.

These help hedge funds obtain confidence that they have the system and data for disaster situations. Disaster recovery planning needs periodic testing to identify holes and polish recovery strategies with minimal interruption.

Advantages of hedge fund cloud security Solutions for Hedge Funds

The benefits of secure cloud infrastructure for hedge funds include improved flexibility, scalability, and competitive advantage. Hedge fund management software can use cloud environments to enhance performance and streamline operations. The adoption of cloud services has to go hand-in-hand with diligent security practices.

Cloud security solutions help hedge funds secure client information, stay compliant, and respond quickly to security threats. Moreover, with its robust security features, the hedge fund management application enables hedge funds to automate every process, manage risks appropriately, and safely obtain valuable insights from data analytics.

A hedge fund cloud security solution tailored to the fund’s specific needs allows it to capture profits from the cloud while maintaining robust security and regulatory compliance. This approach improves operational resilience and helps hedge funds meet regulatory and client expectations for data security.

FINAL THOUGHT

The hedge fund industry has embraced cloud computing’s fast turnaround, offering efficiency and scalability for modern finance. Hedge funds that integrate the cloud deeply face security concerns like protecting sensitive data and ensuring compliance. To secure cloud environments, hedge funds must focus on security solutions, prioritize data protection, and implement disaster recovery plans.

Effective strategies should include multiple physical and virtual security layers, strict adherence to policies, and ongoing compliance. Investing in secure, compliant cloud infrastructure does not automatically build client trust or protect client data. It also does not guarantee resilience against new threats.so doesn’t guarantee resilience against new threats.

FAQ’s

Common hazards include data breaches, cyber-attacks, insider threats, and regulatory non-compliance.

Best practices include multi-factor authentication, encryption, regular audits, and strict access controls.

Encryption protects sensitive data through conversion into unreadable code to ensure data privacy and compliance.

The hedge fund continuously monitors, analyzes the risk, configures securely, and develops an incident response.

The solutions in the cloud provide better disaster recovery as these represent data backup, redundancy, and easy access to recovery resources.