Today, every kind of asset is regulated globally. In the world of hedge funds, following all the legalities, requirements, policies, and regulations is crucial in maintaining operational integrity, clearing audits, and preventing the risk of high legal penalties or violation charges and loss of trust from big investors. Just like managing hedge funds is becoming more complex daily, hedge fund managers require different hedge fund software for every sort of task. Managing software to manage hedge funds for multiple billing processes. We have hedge fund billing software for the management of adhering to legal regulations and policies and compliance with regulatory bodies, and hedge fund legal software comes into play.

Hedge fund Legal software

It is an effective technology, specialized software designed to assist the legal team in managing and acquiring the complex regulatory compliance required for hedge funds. As hedge funds operate in highly regulated surroundings, legal compliance is essential to avoid potential threats to reputation or penalties. It helps hedge funds automate, track, and manage compliance tasks smoothly, reducing risks and streamlining the regulatory tasks associated with legal compliance.

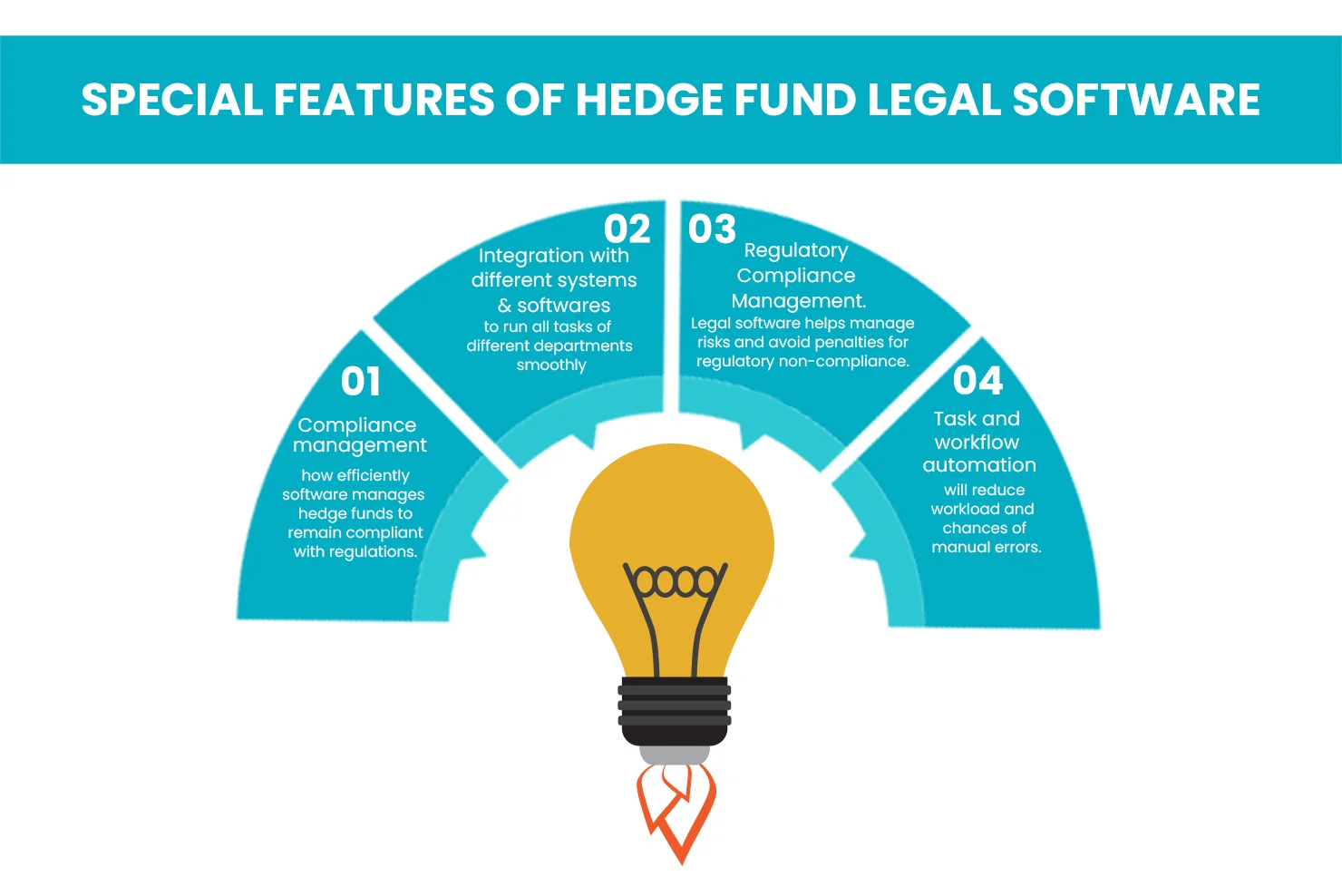

Special features of Hedge Fund Legal Software

There are many features legal software has that should be looked upon before choosing your software.

Compliance Management:

Different modules will be available specifically to comply with relevant regulations, such as SEC filings, Form ADV, FATCA (Foreign Account Tax Compliance Act), and other regulatory bodies.

Task and Workflow Automation:

Hedge fund legal software can automate repetitive tasks like report generation, filing, or tracking, which, in turn, reduces the probability of manual errors and saves time. Moreover, legal software should be able to generate such reports based on standard parameters, while also remaining updated with new options and features.

Integration with Different Systems:

Hedge fund legal software can integrate with different hedge fund management software and systems, such as portfolio management or trading platforms, and with accounting software, which is vital for this software. This feature allows us to perform tasks smoothly between different platforms, reducing errors and improving compliance.

Managing potential risks:

Hedge fund legal software must have a complete set of tools to distinguish potential threats or legal and regulatory risks from multiple tasks. Such tools help managers stay alert regarding any changes in laws or the generation of new regulations and take essential steps to maintain integrity and compliance.

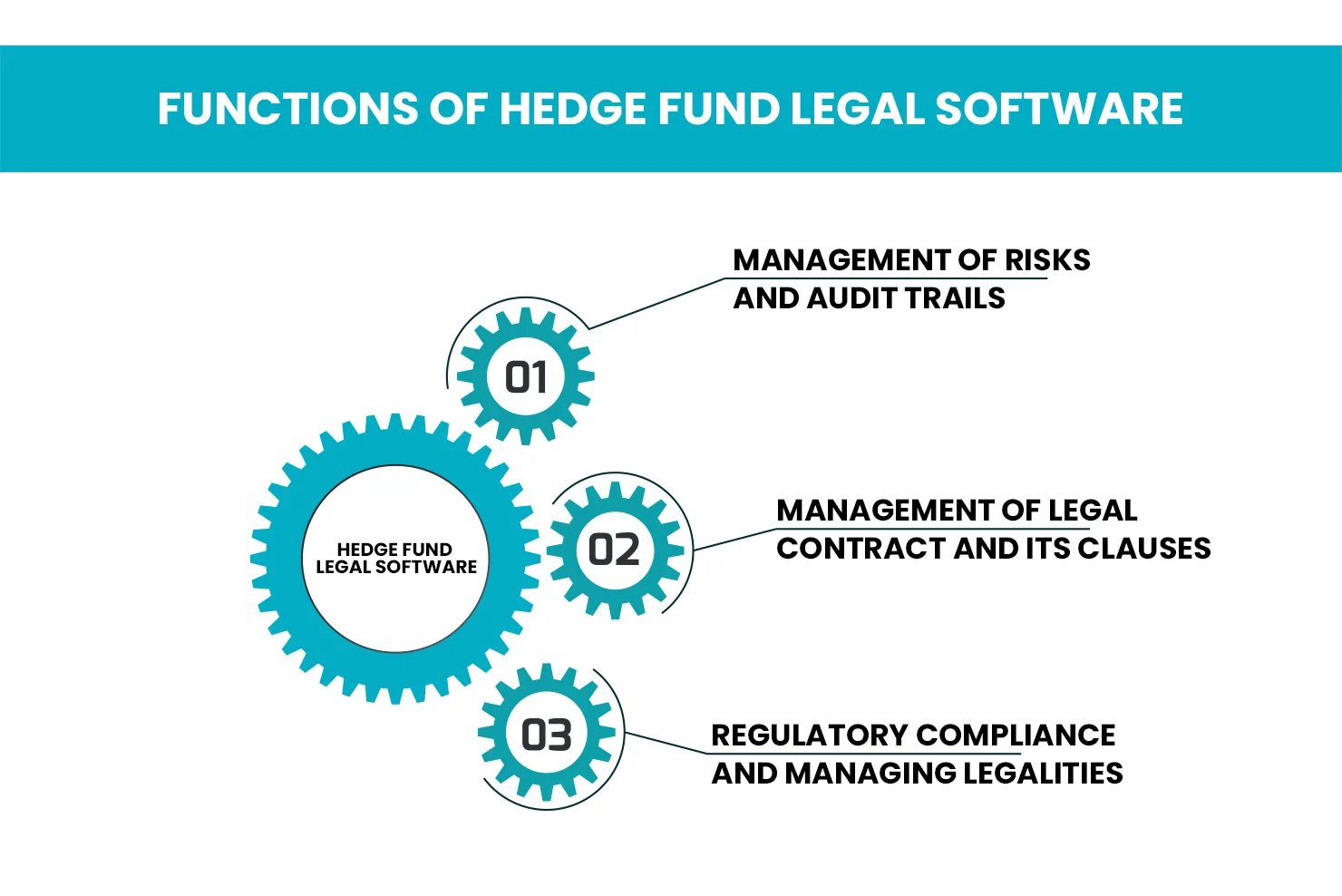

Functions of Hedge Fund Legal Software

There are many important functions of it, and a few are discussed below.

Management of risks and audit trails:

This software helps hedge funds manage potential regulatory or legal risks. It helps the legal team identify and eliminate any severe threats and compliance risks and also tracks obligations across different jurisdictions worldwide. For auditors, it forms an audit trail that keeps a record of all the actions taken within the system, which is significant during audits or regulatory inspections, avoiding penalties and charges.

Management of legal contract and its clauses:

Hedge funds engage in legal agreements with investors, clients, and service providers. Legal software is required to manage all the legalities, clauses, and conditions in the contract or simply manage the entire contract. Managing tools can fulfill these functions by creating the contract according to the relevant laws and tracking the contract.

Regulatory Compliance and Managing Legalities:

The primary function of hedge fund legal software is to manage the regulatory compliance of hedge funds. In doing so, it ensures that hedge funds adhere to legal policies, regulations, and rules, thereby making operations run smoothly. Specifically, the legal regulations include securities laws, anti-money laundering regulations (AML), Foreign Corrupt Practices Act (FCPA), Know Your Customer (KYC) policies, and the reporting of all obligations to agencies such as the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

Fund managers opt for compliance software for hedge funds to remain in compliance with these regulations. Compliance software assists managers in keeping their hedge fund pool aligned and compliant with regulatory bodies and policies. As for hedge fund legal software, its integration feature can integrate with different compliance software for financial services to improve hedge fund compliance.

For compliance, there are investment advisers compliance consultants, registered with regulatory authorities who can guide managers to improve hedge fund compliance.

RIA Compliance Software

RIA compliance software is a tool that helps registered investment advisers (RIAs) and their firms perform automated and regulatory compliance tasks smoothly. As a result, RIA compliance software has become really useful and popular among registered investment adviser compliance consultants, hedge fund managers, investors, and brokers. Furthermore, it ensures that RIAs comply with regulatory policies imposed by the Securities and Exchange Commission (SEC).

Advisors or consultants who use RIA compliance software and provide consultancy for a fee must comply with various compliance standards, especially those set by the Investment Advisers Act of 1940, Form ADV, and Form CRS, along with other standard policies.

Benefits of Hedge Fund Legal Software

There are many more benefits of hedge fund legal software; however, only a handful are discussed here.

It improves overall compliance and efficiency, reduces time, cost, and probability of manual errors by automating compliance workflow and documentation, and assists the legal team by reducing manual workload.

The software reduces the need for complex and extensive manual processes, which cuts and lowers operational costs. Secondly, complying with all regulations prevents hedge fund managers from heavy legal penalties for noncompliance.

Legal software helps hedge funds reduce the risk of failing to comply with regulations, especially where non-compliance can lead to substantial financial penalties. It automatically tracks legal obligations, provides real-time regulatory updates, and tracks audit trails.

FAQ’s

An effective technology is specialized, designed software that assists the legal team in managing and acquiring the complex regulatory compliance required for hedge funds.

Legal software is important because it ensures hedge funds’ adherence to regulatory bodies like the SEC and CFTC laws to prevent reputational damage or heavy legal penalties.

Key features include compliance management, task and workflow automation, prevention of potential risks and reputational damage, and integration with other systems.

It performs automated regulatory reporting, ensuring that hedge funds stay aligned with updated regulations and policies. As a result, this helps maintain regulatory compliance effectively and efficiently.

Hedge funds must comply with regulations such as the CFTC, FCPA, SEC, FINRA, Know Your Customer KYC, AML, and many more.