Execution Management System for Hedge Funds

Introduction

Today, Hedge funds operate in an extremely competitive finance domain, wherein execution speed can be a deciding factor for hedge funds. In this challenging terrain, hedge funds use an Execution Management System, a specialized software package that helps simplify trading, cut costs, and optimize performance. This paper delves into the ins and outs of hedge fund execution management, including differences from Order Management Systems and some of the most important trends, challenges, and solutions in the hedge fund management software area.

What is an Execution Management System?

An EMS is a technology platform firms and hedge funds use to conduct and manage their trades. Its chief objective is to optimize trade execution, enabling traders to make quick and efficient decisions about trade execution. EMS solutions involve real-time market data analysis, order management, and risk assessment capabilities, thus representing a lifeline for managing hedge funds.

Core Capabilities of an Execution Management System

Real-time market information access—An EMS furnishes market data in real-time, offering its traders all price feeds, liquidity data, and depth information, which would be beneficial for making appropriate, relevant, and time-sensitive trades.

Order Routing and Execution:

EMS solutions route orders effectively. This means the trade gets executed across various venues, where traders obtain the best price, reducing the market’s impact.

Execution Algorithms:

Most EMS solutions use advanced execution algorithms. These algorithms are designed to understand market conditions most finely to optimize the order. As a result, the algorithms help the trader find an optimal trade between speed and price.

Risk Management Tools:

An EMS offers risk management functionalities. It allows traders to track positions and estimate the real-time risks associated with such positions, which is essential for the overall integrity of the portfolio.

Performance Reporting and Analytics:

EMS delivers reporting tools that permit hedge funds to explore trading performance. Documented trade data can be utilized to spot trends, optimize strategies, and drive better conclusions.

Hedge Fund Execution Management vs. Order Management Systems

In the kingdom of trading technology, the difference between an Order Management System and an Execution Management System is important. Although both play critical roles, they fulfill different parts of the trading process.

What is OMS?

The Order Management System relates mainly to the order lifecycle. An OMS empowers traders to control each phase of order creation, tracking, and execution. Core features of an OMS include:

- Order entry and modification

- Trade matching and reconciliation

- Compliance monitoring

- Integration with clearing and settlement systems

Whereas an OMS is essential for tracking and executing orders correctly, it doesn’t focus as much on the execution process as an EMS.

OMS vs. EMS

The following differences become apparent when comparing OMS vs EMS

Focus:

OMS focuses more on order management, tracking, and compliance, while EMS focuses more on optimizing trade execution and speed.

Functionality:

EMS solutions are more composed of execution algorithms and real-time market data integration than OMS.

User Base:

OMS is more recognized for its procedures and compliance teams. Regardless, traders often use EMS, especially those who need to process fast executions and analyze large amounts of data.

Integration:

Several hedge funds employ both systems, using each in conjunction to leverage the strengths of each system and enhance their trading operations.

Hedge funds must understand the difference between OMS and EMS to improve their execution process. With the right system integration, hedge fund execution management will improve.

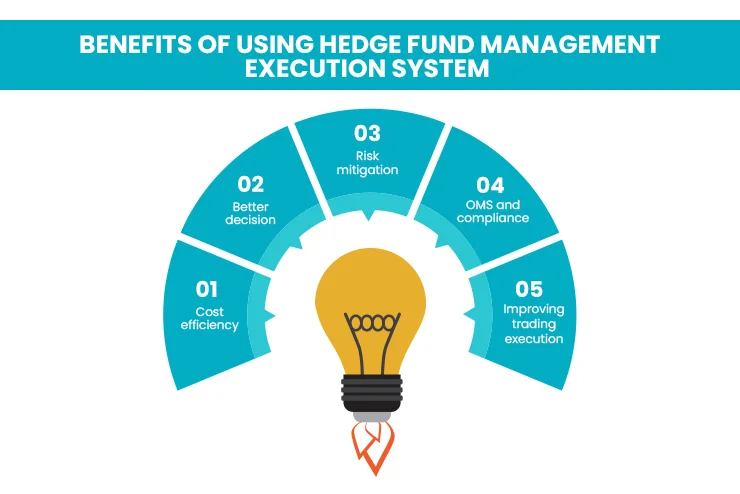

The efficiency of hedge funds in operations depends on their Execution Management Systems. It is through EMS that hedge fund management is made easier:

1. Improving Trade Execution

The hedge fund execution management software assists traders in trading promptly and accurately. EMS has almost eliminated human errors by automating the entire process of order routing and execution. The process further decreases time, a basic requirement in any marketplace where time is money to produce the maximum profit.

2. Better Decision

With real-time market data and sophisticated analytics, traders can make quick decisions. An EMS allows traders to analyze market conditions and change according to their strategies. Adaptability is what these fluctuating times of hedge fund management demand.

3. Risk Mitigation

First, hedge funds strictly require efficient risk management. An EMS provides its clients with the means to monitor positions in real-time and measure possible risks that may appear from them. Introducing an extra risk limit and corresponding alerts will keep excessive losses away from the fund and maintain stability for the overall portfolio.

4. Cost Efficiency

Hedge funds would optimize execution to reduce slippage and transaction costs in such investments. The EMS would, therefore, ensure that trading is as smooth as possible, providing better pricing at lower fees. This cost efficiency then directly affects the returns on investment.

Best Execution Management System Vendors to Choose

Some things hedge funds should look at before settling on an Execution Management System are the reputation of a vendor, the technological innovation, and the support services provided. Some considerations are the following:

1. Reputation and Experience

A hedge fund should seek an execution management system vendor with a good name in the financial industry. Established vendors have typically provided well-proven solutions for clients and work with highly experienced teams, which can be very important for implementation and after-sales support.

2. Customization and Flexibility

All Hedge funds have Customization needs and strategies. Thus, the selected EMS must be prepared to customize for the fund’s requirements. Any deal must also offer the flexibility to modify existing systems while maintaining smooth processes.

3. Technology and Features

The technology stack and other features drawn through an offer shall be cross-checked. Crafting a sound EMS to be applied would necessitate supporting complex execution algorithms, integration of real-time data of markets, and other reporting capabilities.

4. Support and Training

Vendor support becomes one critical parameter while implementing and operating the EMS. This includes hedge funds requiring training resources regarding which customer support is offered and facilities about the ongoing maintenance of a vendor.

Trends Adjusting Execution Management Systems

There is a constant evolution in execution management systems. The scope includes technological changes and shifts in market dynamics. Therefore, here are some notable trends:

1. Artificial Intelligence and Machine Learning

AI and machine learning change the very nature of EMS. With these technologies, systems can analyze huge volumes of data, identify patterns, and optimize execution strategies. For example, a trader can use machine learning algorithms to predict the market’s movement, enabling him to trade in the most responsive market.

2. Higher Automation

Automation has become a vital principle of trading operations. Hedge funds are implementing EMS solutions to automate processes that execute orders and manage risks. The focus is shifting, so the trader has more time to concentrate on strategy instead of trying to execute himself.

3. Integration with Portfolio Management Software

EMS combined with portfolio management software for hedge funds attracts increasing interest. In this way, hedge funds can gain a holistic view of both to understand their trading activities and overall portfolio performance. In this context, EMS enables better decision-making and risk-management capabilities.

4. Cloud-based solutions

Cloud-based EMS solutions can easily scale up and do not incur much infrastructure expense. Hedge fund operations can access Execution management System trading remotely, thereby allowing effective coordination among teams and optimization of operational efficiency.

5. Compliance

As regulations develop, hedge funds can be forced to change aspects of their operations to stay afloat. EMS solutions start having compliance features, assisting hedge fund companies in automating reportage and complying with such regulatory requirements.

Challenges Faced in Implementing an EMS

Although the benefits of having an EMS are obvious, hedge funds still have quite several challenges associated with its implementation:

1. Expensive Implementation Costs

An EMS is quite expensive, especially if proprietary systems are involved. Hedge funds would have to weigh investment against long-term benefits that are likely to be gained, which could be quite burdensome to smaller firms.

2. Integration Problems

The integration of EMS with other systems is challenging. Hedge funds mainly use diverse technologies for other functions, and effective communication among the systems is required to ensure efficiency in business operations.

3. Adoption and Training of Users

Even the best EMS will not deliver results if users are not adequately trained. Hedge funds must invest time and resources in training staff to properly utilize the system and fully exploit its potential.

4. Data Security Concerns

Greater dependence on technology also brings the possibility of cyber threats and data breaches. Thus, hedge fund EMS should emphasize information security to protect sensitive trading information and gain confidence in investors.

Distinctive Execution Management System Products

One has many leading providers of Execution Management Systems whose products, of course, are suitable for hedge funds. These include the Execution Management System Celonis, which gained notoriety for its excellence in process mining. This boosts the operations efficiency of hedge funds to help them gain a clear picture and then optimize execution strategy.

Second, most OMS vs EMS providers provide fully integrated solutions. Most of them combine the strengths of the two systems for hedge funds to operate and streamline operations from the system’s two different strengths.

Conclusion

Today, hedge funds increasingly rely on Execution Management Systems to remain ahead of the curve regarding the intricacies of a financial market. Optimizing trade execution, improving business decision-making, and mitigating risk are significant benefits EMS solutions provide in this context of hedge fund management, which requires an analysis of the differences between an OMS and an EMS.

With continued technological advancements, the EMS will continue to grow in its potential as further AI, automation, and data analytics breakthroughs occur. Hedge funds embracing robust execution management solutions will be well-positioned to improve operational efficiency, tackle regulatory challenges, and produce superior returns for investors.

Success and growth in a competitive landscape, where every basis point and second counts, will critically depend on the right hedge fund execution management systems aligned with more comprehensive hedge fund management software.

FAQ’s

Hedge fund management software mainly meets its specific needs, such as portfolio, risk, and compliance management.

Dedicated EMS feeds to hedge funds in terms of faster, more accurate trade executions, managing more difficult strategies, and removing latency.

An EMS will be efficient if it streamlines processing, decreases latency, and is tied into real-time data, optimizing trade decisions and outcomes.